AUD Rebounds Slightly on Jobs Data, Eurozone PMIs in Focus

The Aussie came under some selling interest yesterday, perhaps as risk appetite eased somewhat during the US session. That said, it rebounded overnight, aided by Australia’s jobs data, but the recovery was not enough to push it into the gainers’ list. The Loonie also received a boost from Canada’s CPIs, while the pound slid somewhat after the UK inflation prints. As for today, attention is likely to turn to the preliminary Euro Area PMIs for April, as investors look for updated information with regards to the bloc’s economic performance.

Risk Appetite Eases Somewhat, Australian Jobs Growth Beats Estimates

The dollar traded higher against all but one of the other G10 currencies on Wednesday. It underperformed only against the safe-haven JPY. The greenback gained the most versus CHF, NOK and AUD in that order, while it capitalized the least against CAD.

The strengthening of the dollar and the yen and the retreat in the commodity-linked currencies suggest that risk appetited eased at some point during the day. Indeed, major EU indices closed in the green, perhaps as investors continued to cheer China’s better-than-expected GDP, but in the US, Dow and Nasdaq closed nearly unchanged, while the S&P slid 0.23%. During the Asian morning Thursday, Japan’s Nikkei and China’s Shanghai Composite declined 0.84% and 0.40% respectively. With no clear catalyst behind the change in investor morale, we prefer to see that as a corrective setback of the preceding rally, perhaps due to profit taking.

Back to the currencies, the Canadian dollar was the currency that weakened the least against its US counterpart, holding strong after Canada’s inflation data. The headline rate rose to +1.9% yoy from +1.5%, while the core one ticked up to +1.6% yoy from 1.5%. Most importantly, the median CPI rose from an upwardly revised +1.9% yoy to +2.0%, which is the BoC’s inflation aim. This may have been pleasant news for BoC policymakers but taking into account the soft employment report for March, and especially the disappointing BoC Business Survey for Q1, we believe that policymakers are nowhere close to start thinking about hikes again. After all, they abandoned their hiking bias just at the previous meeting and we doubt that they will bring it back at the next one, which is scheduled for next week. We believe that they may prefer to wait for more improvement in data, as well as in the global trade front, before they start examining whether they should do that.

We also got CPIs from the UK. Both the headline and the core CPI rates remained unchanged at +1.9% yoy and +1.8% yoy, instead of ticking up to +2.0% and +1.9% as the forecasts suggested. The pound slid only 25 pips at the time of the release, which combined with the muted reaction to Tuesday’s employment report, suggests that investors keep their gaze locked on the political landscape, awaiting Brexit-related headlines. Perhaps they believe that the BoE’s hands will remain tied until the Brexit riddle is resolved. That said, as we noted yesterday, we prefer to wait for the next BoE policy gathering to shed some light on the Bank’s future plans.

The Swiss franc was the main loser, while the Aussie was the third one in line. The franc has been under selling interest recently, perhaps due to the latest risk-on trading activity. This week, its tumble accelerated, perhaps due to comments from SNB President Thomas Jordan over the weekend. Jordan said that that the Bank remains willing to intervene in the FX market and could further reduce interest rates if needed.

Passing the ball to the Aussie, it traded sideways during the European morning, after the spike up due to China’s GDP data, but came under selling interest near the US opening, perhaps due to the deterioration in risk appetite. It rebounded again overnight, aided by Australia’s jobs data for March, but the recovery was not enough to bring it back into the winners’ list. The unemployment rate ticked up to +5.0% from 4.9%, but the net change in employment showed that the economy gained 25.7k jobs, more than February’s 4.6k, and more than the 12k forecast. Bearing also in mind that the participation rate has ticked up as well, we believe that part of the rise in the unemployment rate may be due to more people being encouraged to actively start looking for a job.

The RBA places a lot of emphasis on the employment data and the overnight release eases somewhat concerns with regards to an imminent rate cut. However, bearing in mind the Bank’s dovish stance at the previous gathering, we cannot rule out a cut later this year. Aussie traders would have to stay tuned for next week’s inflation data, where a disappointment could well prompt them to bring forth the timing of when they expect a rate decrease, and thereby the Aussie could slide again.

That said, we repeat for the umpteenth time that the Aussie is also sensitive to changes in the broader market sentiment. Despite the ease in risk appetite during the US session yesterday, the broader trend remains positive, we believe, which is a supportive factor for the risk-linked AUD. So, having all that in mind, we would expect it to perform relatively well against currencies which tend to weaken during periods of optimism, like the safe-havens JPY and CHF. With the latest round of dovish remarks form SNB’s Jordan, we see the chances for AUD/CHF to continue performing better than AUD/JPY.

AUDCHF — Technical Outlook

From the beginning of April, AUD/CHF has been under the dictatorship of the bulls, which led the rate to accelerate quite significantly. The pair continues to trade above its short-term upwards-moving trendline taken from the low of April 3rd. Recently, AUD/CHF found good resistance near the 0.7260 barrier and is now balancing slightly below that level. From the very short-term perspective, we may see the rate correcting back down a bit, but if the above-mentioned upside line holds, then AUD/CHF could experience another leg of buying, which may lift the rate beyond the recent highs.

If the above-mentioned scenario starts playing out, AUD/CHF could drop to the 0.7230 hurdle, marked by yesterday’s low. Even if the pair travels a bit lower, the bears might get held by the previously-mentioned upside support line, which could act as good bouncing ground for the rate. If such a move occurs, AUD/CHF could travel all the way back to the 0.7260 obstacle, a break of which may attract even more buyers and allow the pair to continue drifting north. The next potential resistance area could be around the 0.7290 level, marked by the highs of November 29th and December 5th.

On the downside, a break of the aforementioned upside line and a rate-drop below the 0.7208 hurdle could open the door for the pair to travel to the support area between the 0.7175 and 0.7167 levels, where the last one marks the low of April 16th. If the selling doesn’t end there, a violation of the last-mentioned level could increase the chances for AUD/CHF to make its way to the 0.7137 hurdle, marked by the low of April 12th.

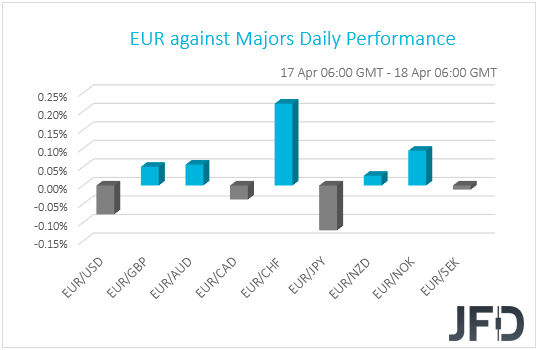

EUR Trades Quietly Ahead of Euro Area PMIs

The euro was found within a ±0.10% range against most of the other G10 currencies. It gained more only against CHF, while it lost more only against JPY.

The common currency may have entered a quiet mode, as investors await for the Euro area preliminary PMIs for April. The bloc’s manufacturing index is expected to have rebounded to 47.9 after hitting 47.5 in March, while the services print is forecast to have ticked down to 53.2 from 53.3. This would drive the composite index a tick higher, to 51.8 from 51.6, but in our view, it would still be far from suggesting that the Euro area economy has turned the corner.

Last week, Draghi and co. reiterated their guidance that interest rates are likely to stay at present levels “at least through the end of 2019”, with the ECB Chief noting again that the risks surrounding the euro area economic outlook “remain tilted to the downside”. He also added that policymakers will consider “whether the preservation of the favorable implications of negative interest rates for the economy requires the mitigation of their possible side effects, if any, on bank intermediation”. Thus, although the PMIs would still be far from exciting (according to the forecasts), they could lessen somewhat the need for additional policy measures beyond the new round of TLTROs, which is expected to begin in September, and may thereby provide some support to the euro.

EUR/USD — Technical Outlook

EUR/USD keeps forming higher lows, but is struggling to make higher highs, as the pair is finding it difficult to overcome the 1.1325 barrier. Also, there is a short-term upside support line taken from the low of April 2nd, which is supporting the rate in its journey higher. That said, because the EUR/USD had once again made its way back down to the above-mentioned upside line, we would need to see a strong bounce from it and a push through the 1.1325 barrier first, before we get excited about higher levels again.

As mentioned above, a move through the 1.1325 hurdle would confirm a forthcoming higher high and might open the door to the pair’s next potential resistance, at around 1.1342, marked by the intraday swing low of March 21st. If that area is seen as a temporary pit-stop for the bulls, a break above it could lead EUR/USD towards a higher resistance area, at 1.1390, near the high of March 22nd.

Alternatively, a break of the aforementioned upside support line and a rate-drop below the 1.1280 zone, could spook the bulls from the field and allow the bears to take control of EUR/USD at least for a while. The rate might then slide to the 1.1250 hurdle, which acted as good support on April 11th. But if this time the hurdle is not able to withstand the bear-pressure, a break of it could drag the pair towards the 1.1230 zone, marked near the low of April 10th.

As for the Rest of Today’s Events

Apart from Eurozone’s PMIs, we get the preliminary Markit PMIs for April from the US as well. The manufacturing index is forecast to have risen to 52.8 from 52.4, while the services one is expected to have slid to 55.0 from 55.3. Initial jobless claims for the week ended on April 12 thare also coming out.

We also get retail sales data from the UK, the US and Canada. The UK and US data are for March, while Canada’s release is for February. Getting the ball rolling with the UK prints, both headline and core sales are forecast to have declined -0.3% mom, after rising +0.4% and +0.2% respectively. That said, this would drive both the yoy rates higher, to +4.6% and +4.0% from +4.0% and +3.8% respectively. In the US, both the headline and core rates are forecast to have rebounded to +0.9% mom and +0.7% mom, from -0.2% and -0.4% respectively, while in Canada, the headline rate is expected to have risen to +0.5% mom from -0.3%, and the core one is anticipated to have ticked up to +0.2% mom from +0.1%.

As for tonight, during the Asian morning Friday, Japans CPIs for March are scheduled to be released. The headline rate is expected to have risen to +0.5% yoy from +0.2%, while the core one is anticipated to have held steady at +0.7% yoy. The case for a rebound in the headline print and stable core rate is supported by the Tokyo CPIs for the month, which moved in a similar fashion. A potential rebound in the headline rate could be somewhat encouraging news for BoJ policymakers, but bearing in mind that all Japan’s inflation metrics remain well below the Bank’s objective of 2%, we stick to our longstanding view that Japanese officials have still a long way to go before they start examining whether they should alter their ultra-loose policy. On Monday, Governor Kuroda said that there is still room for further monetary easing if needed, but he added that this is not necessary at this stage.

We also have one speaker on the agenda: Atlanta Fed President Raphael Bostic.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure .

Copyright 2019 JFD Group Ltd.

Originally published at https://www.jfdbank.com on April 18, 2019.