BoC Mimics the FOMC and Cuts by 50bps, OPEC+ Enters the Limelight

EU indices continued trading north yesterday, perhaps on expectations that more central banks, including the ECB, will follow the FOMC in easing policy. Risk appetite was boosted further during the US session after the BoC delivered a 50bps cut as well, something that pushed the Loonie lower. As for today, CAD and oil traders are likely to lock their gaze on the OPEC+ two-day meeting in Vienna.

BoC Delivers a Double Cut, Stands Ready to Ease More

The dollar traded mixed against the other G10 currencies on Wednesday and during the Asian morning Thursday. It gained versus CAD, EUR and SEK in that order, while it underperformed against GBP, NZD and AUD. The greenback traded virtually unchanged versus CHF, JPY and NOK.

The strengthening of the risk-linked currencies Aussie and Kiwi, combined with the relative weakness of the safe havens, suggests that risk appetite remained supported for another day. Indeed, major EU indices kept trading in green territory, perhaps on expectations that other central banks, including the ECB, will follow the footsteps of the FOMC in easing policy to fight the coronavirus’s economic impact. Investors increased further their risk exposure during the US session perhaps due to a second double cut, this time by the BoC. The strong performance of Joseph R. Biden in the Democratic nomination campaign may have also been a reason for buying US stocks, as he is considered less likely to increase taxes and tighten regulations for US firms than his rival Bernie Sanders. The US House of Representative also agreed over an USD 8.3bn bill to fight the virus, with the legislation being sent for approval in the Senate. The positive investor morale rolled over into the Asian session today, with Japan’s Nikkei 225 and China’s Shanghai Composite gaining 1.09% and 1.94% respectively.

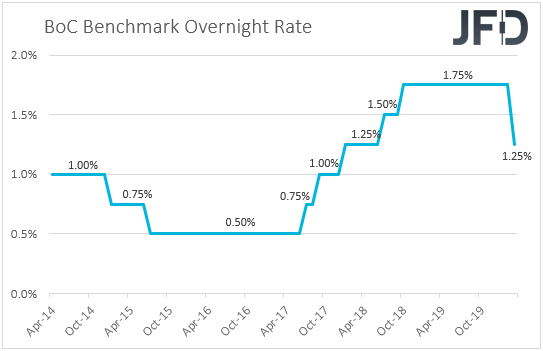

Back to the currencies, the Loonie was the main loser, coming under strong selling interest after the BoC decided to cut its benchmark interest rate by 50bps, mimicking the Fed and noting that the coronavirus is a material negative shock to the Canadian and global economic outlooks. Expectations were for a 25bps cut, and that’s why the Loonie tumbled on the delivery of a double decrease. Policymakers’ readiness to ease further if needed may have also weighed on the currency.

As we noted yesterday, the path of least resistance for the Loonie may be to the downside. We stick to our guns that central bank rate cuts may not be enough to offset the economic damages caused by the fast spreading of the coronavirus and anything suggesting that this is the case may trigger another round of risk aversion, which could hurt oil prices and thereby the Canadian dollar. Let’s not forget that Canada is the world’s seventh largest oil producing nation and the fourth in terms of exports.

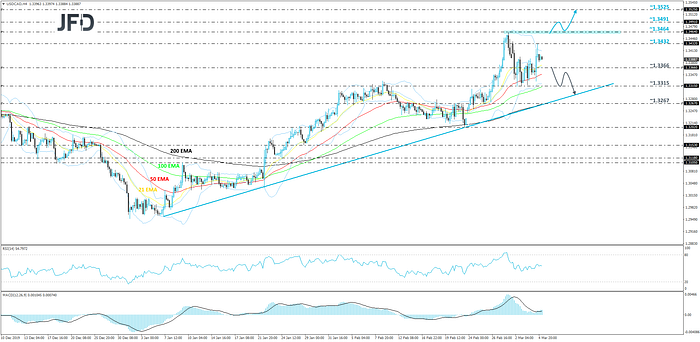

USD/CAD — Technical Outlook

Overall, USD/CAD remains above its short-term upside support line taken from the low of January 7 th. However, the pair has been trading in an undecisive manner lately. Although the trend is still to the upside, in order to aim for higher areas, we would first like to see a break of the February high, at 1.3464.

If the rate climbs higher and overcomes the above-discussed barrier, at 1.3464, this may lead to some higher areas, as the pair would confirm a forthcoming higher high. That’s when we might target an intraday swing low of June 3 rdof 2019, at 1.3491, a break of which could open the door to some higher levels. The next potential resistance zone could be seen around 1.3527, marked by the high of the same June 3 rd, 2019.

Alternatively, a drop back below the 1.3366 territory, which is an intraday swing high of March 4 th, would also place the rate below the 20 SMA of the Bollinger Bands. Such a move might worry some of the buyers, who may temporarily leave the arena and allow the sellers to drag USD/CAD a bit lower for a deeper correction. We will then aim for the 1.3315 support area, marked by the current lowest point of March. Initially, the rate might stall around there, or even rebound somewhat. That said, if the pair struggles to climb above the 1.3366 hurdle, we could see another round of selling, possibly leading to a break of 1.3315 obstacle. If so, we will then aim for the aforementioned upside line, which might provide additional support and stall the rate.

Oil Traders Lock Gaze on OPEC+ Meeting

As for today, Loonie and oil traders are likely to lock their gaze on the meeting between OPEC and major non-OPEC oil producing nations in Vienna. The meeting concludes tomorrow. The so-called OPEC+ group has been already curbing output by 1.7mn barrels per day (bpd), a deal that expires in the end of this month. That said, lower demand due to the coronavirus has led the Joint Technical Committee to recommend an extra output cut of 600.000 bpd. However, it seems that this number was not enough for market participants, who allowed crude prices to continue tumbling after the announcement. According to reports, that number is now insufficient for some of the group’s members as well, one of which is Saudi Arabia. Sources said that those members are considering an output cut of 1mn bpd, a deal that should run throughout the second quarter. There were also fresh reports yesterday, suggesting that OPEC is pushing for more than 1mn. However, other sources were quick to respond and say that Russia has opposed to anything above 1mn.

As for our view, taking all this information, we believe that the market consensus may be between 600k and 1mn. Thus, anything within that range is unlikely to result in a major market reaction in oil prices and the Canadian dollar. For a decent rebound to occur, producers may need to deliver something above and beyond 1mn. Now, in case the number is below 600k (or in the extreme case of no new cuts), oil prices, as well as the Loonie, are likely to tumble instantly, accelerating their prevailing downtrends.

WTI Oil — Technical Outlook

WTI oil continues to trade below its short-term tentative downside resistance line taken from the high of January 8 th. Recently, the commodity found good support near the 43.37 hurdle, from which it rebounded. Although we may get a bit a bit more upside in the near term, as long as that downside line stays intact, we will continue targeting the downside.

As mentioned above, we might see a bit more upside, where the price could end up traveling above the high of this week, at 48.50, and testing another possible resistance zone, at 50.23, marked by the high of February 26 th. Around there the black liquid might get a hold up from the aforementioned downside line. If so, the bears might re-enter the field and drag WTI oil back down. If the price slides all the way back below the 48.50 hurdle, this may clear the path to the 46.47 obstacle, or even the 44.69 level, marked by an intraday swing low of March 2 nd.

On the other hand, if the previously-mentioned downside line breaks and the price moves above the 200 EMA on the 4-hour chart, and also above the 51.80 barrier, which is the high of February 25 th, this might attract more bulls into the field. We will then aim for the 54.35 zone, marked by the highest point of February. The black liquid may temporarily stall around there, but if the buying continues, a break of that zone would confirm another forthcoming higher high and could lead to a test of the 55.93 level, marked by the high of January 24 th.

As for the Rest of Today’s Events

During the US session, we get the US factory orders for January, the Unit Labor costs index for Q4 and the initial jobless claims for last week. Factory orders are expected to have slid 0.1% mom after rising 1.8%, while the Labor costs index is anticipated to have slowed to +1.4% qoq from +2.5% in Q3. Initial jobless claims are forecast to have declined somewhat, to 215k from 219k the week before.

We also have six speakers on the agenda. Today, we will get to hear from BoE Governor Mark Carney, BoC Governor Stephen Poloz, and BoE Chief Economist Andy Haldane. Tonight, during the Asian morning, three Fed speakers will step up to the rostrum. Those are Dallas President Robert Kaplan, Minneapolis President Neel Kashkari, and New York President John Williams. We will pay close attention to those speeches as they may provide hints on whether the BoE is also considering to cut when it meets next, and when the BoC and the FOMC may be planning to act again.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Originally published at https://www.jfdbank.com on March 5, 2020.