Equities Rebound as Investors Become Optimistic on Q3 Earnings

European equities finished their session in the red yesterday, perhaps due to the weaker-than-expected growth data from China. However, risk appetite improved during the US session and rolled over into the Asian session today, perhaps as earnings results from big US banks last week sparked optimism for the rest of the season. As for tomorrow, during the early European morning, the UK CPIs for September are due to be released, where elevated rates could add more credence to the view over a BoE hike before year end.

EU Stocks Slide on China’s Slowdown, but US Rebounds on Earnings Optimism

The US dollar underperformed against all the other major currencies on Monday and during the Asian session Tuesday. It fell the most against NZD, AUD, and EUR in that order, while it lost the least ground against JPY.

The strengthening of the risk-linked Kiwi and Aussie, combined with the weakening of the dollar and the yen, suggests that market sentiment turned to risk on at some point during the day. Looking at the performance in the equity world, we see that European shares closed in the red, perhaps as investors were still concerned after the weaker-than-expected growth data from China. The fact that oil prices hit fresh highs may have also dented sentiment during the EU session, as it may have kept concerns over persistently high inflation elevated. However, the picture was different during the US session. Although the Dow Jones slid 0.10%, the S&P 500 and the Nasdaq finished their trading positive, with the upbeat appetite rolling into the Asian session today.

It seems that better-than-expected earnings results from big US banks last week encouraged some market participants to start this week by increasing their risk exposure, as they may have become somewhat more optimistic for the rest of the season. Analysts expect the S&P 500 earnings to rise 32% from a year ago. With several major indices around the globe breaking key technical resistance zones last week, we believe that more positive results could encourage more stock buying. At the same time, risk-linked currencies are likely to benefit, while the safe havens may stay on the back foot. However, as we noted last week, we are reluctant to call for a long-lasting recovery. We prefer to take things step by step, and the reason is that the fundamental background that triggered the latest correction in equities has not changed much. Oil prices remain elevated, which could still lead to further acceleration in inflation and thereby faster tightening by major central banks, while China continues to face several problems, from default risks in the property sector to tight regulations for tech firms and fresh lockdown measures due to the spreading of the Delta coronavirus variant.

Speaking about central banks, during the Asian session today, the RBA released the minutes from its latest monetary policy meeting, but as we have been expecting, there were no fireworks. Just for the record, the minutes confirmed that officials do not want to raise interest rates before 2024, noting that tighter monetary policy would lead unacceptably to fewer jobs and lower wage growth.

Now, flying from Australia to the UK, tomorrow, during the early European morning, the nation’s CPI data for September are coming out. The headline CPI rate is expected to have held steady at +3.2% yoy, while the core one is anticipated to have ticked down to +3.0% yoy from +3.1%. Despite the potential slowdown in underlying inflation, both rates are expected to stay well above the BoE’s objective of 2%. Thus, if the forecasts are met, we doubt that they could alter market expectations around the BoE’s future policy plans. With BoE Governor Andrew Bailey and MPC member Michael Saunders expressing willingness to push the hike button soon, market participants now anticipate a 15bps hike to be delivered before year end.

However, despite the latest rally in the British currency, as we climb higher, we will be more and more careful. In other words, we will continue aiming north, but we are reluctant to call for a healthy long-lasting uptrend. This is because we don’t see much room for hike expectations to come forward, and due to concerning headlines surrounding the UK economy. We may get a clearer idea on that from the preliminary PMIs for October, due out on Friday.

S&P 500 — Technical Outlook

The S&P 500 cash index rebounded yesterday, after it hit support at 4445, and now it is trading within the resistance zone between the 4483 and 4494 barriers, marked by September 27th and 13th respectively. Overall, following the break above the downside line drawn from the high of September 6th, the index continues to climb higher, which paints a positive short-term picture in our view.

We believe that a break above 4494 could encourage advances towards the 4530 zone, marked by the high of September 9th, the break of which may allow a test near the index’s record peak of 4550, hit on September 3rd. If market participants are not willing to stop there either, then a break higher would take the index into uncharted territory and may see scope for advances towards the psychological zone of 4600.

In case the price turns south and falls back below the 4375 barrier, marked by the inside swing high of October 12th, we will abandon the bullish case. This could signal the return back below the aforementioned downside line and could initially target the 4330 zone, which provided support on October 12th and 13th. If the bears do not stop there, the next are to consider as a support may be the low of October 6th at 4284.

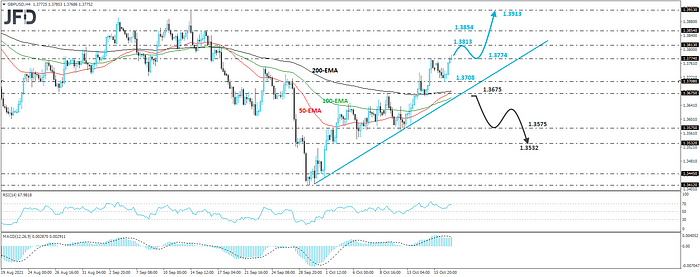

GBP/USD — Technical Outlook

GBP/USD rebounded yesterday, from near the 1.3708 level, and is currently trading slightly above Friday’s high of 1.3774. Overall, the pair continues to print higher highs and higher lows above the upside support line drawn from the low of September 30th, and thus, we would maintain a positive stance for now.

We believe that the break above 1.3774 may have opened the way towards the high of September 17th, the break of which may allow a test at the peak of September 15th, at 1.3854. If the bulls are not willing to stop there, then a break higher could set the stage for advances towards the peak of September 14th, at 1.3913.

On the downside, a break below the 1.3675 zone and the aforementioned upside support line, may be a short-term trend reversal signal. In our view, this could encourage the bears to dive towards the 1.3575 area, which supported the rate on October 12th and 13th, the break of which could pave the way towards the low of October 4th, at 1.3532.

As for the Rest of Today’s Events

The only data releases worth mentioning are the US building permits and housing starts for September, as well as the API report on crude oil inventories for last week. Building permits are expected to have declined somewhat, while housing starts are forecast to have fractionally increased. As it is always the case, no forecast is available for the API number.

As for the speakers, we have, not one, not two, but eight officials on the agenda. From the ECB, we will get to hear from Chief Economist Philip Lane and Executive Board members Frank Elderson and Fabio Panetta, while from the BoE, Governor Andrew Bailey will step up to the rostrum. In the US, the calendar points to speeches from San Francisco Fed President Mary Daly, Atlanta Fed President Raphael Bostic, Fed Board Governor Michelle Bowman, and Fed Board Governor Christopher Waller.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.90% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Originally published at https://www.jfdbank.com.