EU and US Stocks Keep Sliding, but Asians Rebound on China Policy

European and US indices kept sliding yesterday, as investors remained fearful over surging inflation harming more the global economy. Sentiment improved during the Asian trading, after China cut its five-year loan prime rate (LRP) by more than anticipated. However, with the fundamental landscape staying largely unchanged we still believe that the path of least resistance for equities is to the downside and for the dollar to the upside.

China’s Rate Cut Supports Sentiment, but Broader Outlook Remains Dismal

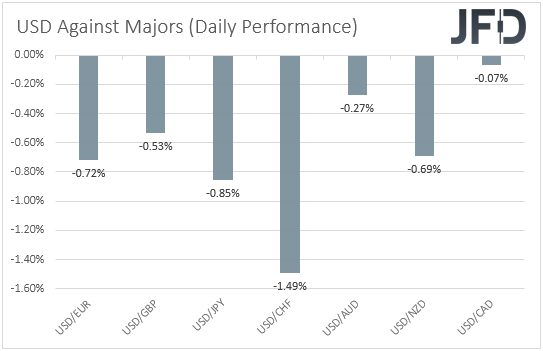

The US dollar traded lower against all the other major currencies on Thursday and during the Asian session Friday, losing the most ground against CHF, JPY, and EUR in that order, and losing the least versus CAD.

The strengthening of the Swiss franc and the Japanese yen suggests a risk-off trading activity, but the weakening of the US dollar points otherwise. Perhaps there was an extension of Wednesday’s risk aversion into Thursday, but things changed at some point during the day or today in Asia. Indeed, turning our gaze to the equity world, we see that major EU and US indices continued to slide, but appetite improved during the Asian session today, with all Asian indices under our radar trading in the green.

It seems that EU and US shares continued to feel the heat of concerns over the effects of high inflation after Target Corp announced that quarterly profits halved and that a bigger margin hit later this year is very likely due to rising fuel and freight costs. What may have prompted investors to extend their selling during the US session, may have been Cisco Systems’ dismal outlook, with the individual stock slumping around 13.7%.

But why did market morale improve during the Asian session today? Perhaps due to China’s decision to cut its five-year loan prime rate (LRP) by 15bps this morning, a deeper-than-expected cut and a decision taken to cushion the economic slowdown. However, the one-year LPR was left unchanged, at a time when most respondents to a Reuters poll have been anticipating 5bps cuts in both rates.

Having said all that, we stick to our guns that the path of least resistance for equities is to the downside, and for the dollar still to the upside. Despite China’s policy move today to support the economy, the nation’s financial hub of Shanghai announced three new coronavirus cases outside of quarantined areas, which could heigh on hopes that strict restrictions and lockdowns could be eased soon. On top of that, concerns over high inflation keep elevated expectations and bets over fast tightening by some major central banks, but also intensify fears over a global recession. And as if stagflation is not an important reason on its own for investors to be nervous, the war in Ukraine is still raging, which could make things worse. Even if it doesn’t escalate to beyond a two-nations military conflict, its prolonged duration could hurt even more global supply chains, and thereby the global economic outlook.

Nasdaq 100 — Technical Outlook

The Nasdaq 100 cash index traded lower yesterday, but hit support at the 11690 zone, marked by the low of May 12th, and then, it rebounded somewhat. Overall, this index remains below the downside resistance line taken from the high of April 5th, and thus, even if the current recovery continues for a while more, as long as the index stays below that line, we will consider the short-term outlook to still be somewhat bearish.

The bears could take charge again soon and aim for another test near the 11690 zone, the break of which would confirm a forthcoming lower low and may initially target the 11505 zone, marked by the low of November 10th, 2020. If the bears are not willing to stop there, then a break lower could carry extensions towards the low of November 2nd, 2020, at 10940.

On the upside, we would like to see a clear break above 12935 before we start examining the bullish case. This could confirm the break above the aforementioned downside line, and may initially pave the way towards the 13545 zone, which provided key resistance between April 26th and May 5th. Slightly higher lies the 13745 barrier, marked by the inside swing low of April 18th, the break of which could carry extensions towards the 14285 zone, marked by the peak of April 21st.

AUD/JPY — Technical Outlook

AUD/JPY has been trading in a consolidative manner since Wednesday, staying between the 89.00 and 90.25 barriers. In the bigger picture, the pair is still below the downside resistance line taken from the high of April 20th, as well as below a shorter-term upside one taken from the low of May 12th. In our view, this suggests that there is a decent chance for the bears to take charge again soon.

If so, we could see another test near the 89.00 zone, the break of which could initially challenge the 88.45 barrier. If that barrier is also broken, then we may experience extensions towards the low of May 12th, at 87.25, where another break could carry extensions towards the 85.85 territory, marked by the inside swing high of March 13th.

On the upside, we will start examining the bullish case upon a break above 92.90. This will take the rate above both of the aforementioned diagonal lines, a move that could encourage the bulls to climb towards the peak of May 4th, at 94.05. If they are not willing to stop there, then we may see them sailing further north, perhaps aiming for the peak of April 20th, at 95.75.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.99% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2022 JFD Group Ltd.

Originally published at https://www.jfdbrokers.com.