Fed Bets and Geopolitical Tensions Are Back in the Spotlight

The US dollar traded higher yesterday and today in Asia, underperforming only against the safe-havens yen and franc. With most equity indices trading in the red as well, this is a classic risk-off trading activity, with the drivers perhaps being St. Louis President Bullard’s hawkish remarks and the increasing tensions in Ukraine.

BULLARD’S HAWKISH REMARKS AND GEOPOLITICAL RISKS WEIGH ON RISKY ASSETS

The US dollar traded higher against all but two of the other major currencies on Monday and during the Asian session Tuesday. It lost ground only versus CHF and JPY, while it gained the most against EUR, AUD, and NZD.

The strengthening of the US dollar and the safe-havens franc and yen, combined with the weakening of the risk-linked Aussie and Kiwi, suggests that markets traded in a risk-off fashion yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that major European shares were a sea of red, with the negative appetite, albeit softer, rolling into the US and Asian sessions.

Remember that at the beginning of last week, investors had been adding to their risk exposure, but we stayed reluctant to call for a long-lasting recovery ahead of the CPIs and the looming geopolitical tensions in Ukraine. Indeed, the picture changed after the US inflation numbers exceeded their own forecasts and after the White House warned that Russia could attack Ukraine any day.

Fed bets and geopolitical tensions remained the main market driver yesterday as well. With regards to the FOMC and its future plans, yesterday, St. Louis Fed President James Bullard reiterated his view for a faster pace of interest-rate liftoffs, adding that the central bank needs to “ratify” market expectations about its upcoming moves. In our view, this means that Bullard may be in favor of a rate path faster even than the current market pricing suggests. Let’s not forget that, last week, Bullard called for a 50bps hike at the March gathering. According to the Fed funds futures, market participants are now fully pricing in more than six quarter-point rate increases by the end of the year, with some of them, indeed, betting on a “double hike” in March.

With regards to the Ukraine saga, President Volodymyr Zelenskiy urged Ukrainians to fly the country’s flags and sing the national anthem on Wednesday, a day some media have cited as the possible start of a Russian invasion. This may have prompted participants to reduce even further their risk exposure, by seeking shelter to safe havens. So, unless we get reliable headlines that a resolution is more probable than an attack, we see the case for equities to continue drifting south, and safe havens to stay supported.

Now, besides headlines surrounding the Fed and Ukraine, overnight, we also got the minutes from the latest RBA monetary policy decision, while today, during the early European session, the UK released its employment data for December. The RBA minutes just confirmed the message we got from the meeting statement, namely that, although inflation has picked up, it is too early to conclude that it is sustainably within the target band. So, with that in mind, investors have barely touched their bets with regards to future rate hikes. As for the UK data, they came in slightly better than expected, with average weekly earnings including bonuses accelerating somewhat instead of slowing as the forecast suggested. Although this could be a sign that inflation could continue trending north, and that faster hikes may appropriate by the BoE, the pound did not react. Perhaps investors prefer to wait for more recent data, like the CPIs for January, due out tomorrow.

DAX — TECHNICAL OUTLOOK

The German DAX cash index traded lower on Monday, but hit support at 14843, a support marked by the low of January 24th, and then, it rebounded to hit resistance near the 15135 level. Overall, the index remains below the upside support line taken from the low of January 24th, and thus, we would see chances for another round of selling soon.

If the bears are willing to jump back into the action, we could initially see them targeting once again the 14843 barrier, the break of which would confirm a forthcoming lower low and may initially aim for the 14705 zone, marked by the low of March 29th, 2021. If the slide doesn’t stop there, then we may experience extensions towards the 14515 territory, marked by the lows of March 22nd, 23rd, and 24th, 2021.

In order to start examining the bullish case again, we would like to see a clear rebound back above 15300. This could confirm the rate’s return above the upside line drawn from the low of January 24th, and may open the path towards the 15510 or 15620 barriers, marked by the highs of February 11th and 10th respectively. Slightly higher lies the high of February 2nd, at 15740, the break of which could carry extensions towards the 15920 zone, defined as a resistance by the high of January 20th.

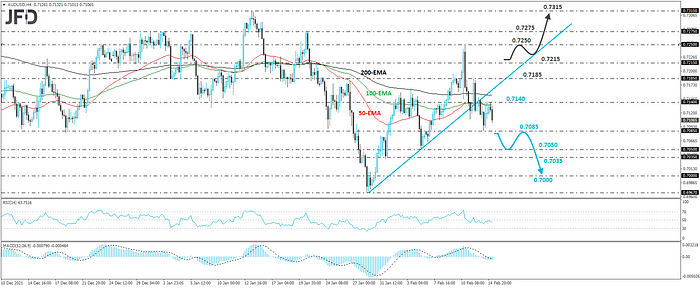

AUD/USD — TECHNICAL OUTLOOK

AUD/USD saw similar trading activity, due to its sensitivity to the broader market sentiment. It slid, hit support at 0.7085, and then, it rebounded to find resistance at 0.7140. However, it stayed below the prior upside support line drawn from the low of January 28th, and thus, we would consider the short-term outlook to still be cautiously bearish.

Another round of selling could take the rate back down to the 0.7085 barrier, the break of which could allow declines towards the low of February 4th, at 0.7050, or the low of February 1st, at 0.7035. That said, if the bears are not willing to stop in neither barrier, then we could see them pushing towards the round figure of 0.7000.

On the upside, we would like to see a recovery back above Friday’s peak, at 0.7185, before w start reexamining the bullish case. This could confirm the return back above the upside line and may target the peak of January 21st, at 0.7215, or the high of February 10th, at 0.7250. Slightly higher lies the 0.7225 zone, marked by the high of January 20th, the break of which could extend the advance towards the peak of January 13th, at 0.7315.

AS FOR THE REST OF TODAY’S EVENTS

From Germany, we have the ZEW survey for February. The current conditions index is expected to have risen to -7.0 from -10.2, while the economic sentiment one is forecast to have inched up to 53.5 from 51.7. As for the Eurozone as a whole, we get the second estimate of GDP and the employment change for Q4. The second GDP estimate is expected to confirm its preliminary print, while no forecast is available for the employment change.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.82% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2022 JFD Group Ltd.

Originally published at https://www.jfdbank.com.