Fed Fights the Coronavirus with Unprecedented Measures

Yesterday, the Fed announced unprecedented measures to shore up the US economy, hit by the fast spreading coronavirus. Although EU and US indices closed their sessions in red territory, Asian ones rebounded to finish positive. The greenback was also found lower against most of the other G10 currencies. Today, attention is likely to turn to the preliminary PMIs for March, as investors are eager to find out how deep the economic wounds resulted in from the spreading of the virus are.

Fed Unveils Aggressive Measures, Global PMIs on the Agenda

The dollar traded lower against the other G10 currencies on Monday and during the Asian morning Tuesday. It gained only versus GBP and JPY, while it was found virtually unchanged against CAD. The greenback underperformed against NOK, AUD, NZD, SEK, EUR and CHF in that order.

The strengthening of the risk-linked currencies, the relative weakness of the yen, and the modest gains of the franc and the euro against the greenback suggest that risk aversion eased somewhat at some point. Indeed, although major EU and US indices closed in negative territory, Asian bourses rebounded and ended in the green today.

Yesterday, the Federal Reserve announced programs considered as “never seen before” intervention into the US economy. The Committee announced that it will purchase corporate bonds, backstop direct loans to companies and will soon initiate a program to provide credit to small and medium-sized businesses. They also announced that they will purchase unlimited amounts of Treasuries and agency mortgage-backed securities in order to allow proper functioning of the US debt market.

EU and US indices saw modest gains after the announcement, but fears over a possible recession due to the damages caused by the fast-spreading coronavirus overshadowed the announcement of the newly-adopted measures, allowing investors to keep abandoning stocks. Another reason why US indices closed negative may have been the US Senate’s failure to agree on a USD 2 trillion economic stimulus package. That said, US Treasury Secretary Steven Mnuchin hinted that nothing is lost, noting that a deal will be reached soon. This, alongside the new measures by the Fed may have eventually prompted some equity buying during the Asian session today.

As for our view, we repeat for the umpteenth time that monetary and fiscal stimulus may not be enough to spark a long-lasting recovery in the broader market sentiment. For this to happen, consumers have to get out of their homes and start spending, while businesses have to start investing in new plans. With the virus still spreading at a fast pace, and new infected cases and new deaths hitting fresh records day by day, we see this as a very hard task.

The restrictive measures are getting tighter and tighter, with mass lockdowns and layoffs deepening the wounds of the global economy. With regards to the US economic activity, investors may be biting their nails in anticipation of Thursday’s initial jobless claims for last week, the forecast of which suggests an increase to 1.0mn from 281k the week before. Imagine if the actual print comes out higher than the forecast. This would mean that the world’s largest economy is getting hit much more severely than many have been anticipating.

Having said that though, ahead of the claims, market participants may pay close attention to the preliminary PMIs for the month of March, which are due to be released today. During the European morning, we get the preliminary manufacturing and services prints from several Eurozone nations and the bloc as a whole. The Euro-area manufacturing index is forecast to have fallen to 39.0 from 49.2, while the services one is anticipated to have slumped to 38.4 from 52.6. This will drive the composite index to 37.8 from 51.6.

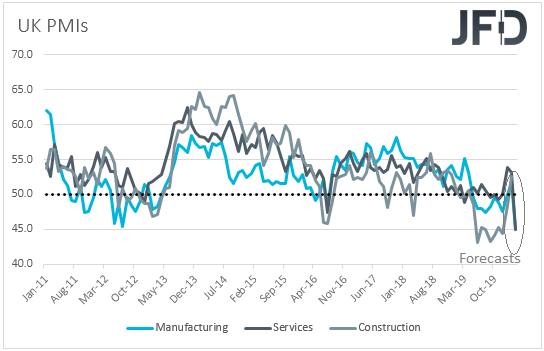

We get preliminary PMIs for March from the UK as well. Both the manufacturing and services indices are anticipated to have declined to 45.0 from 51.7 and 53.2 respectively, with the composite index expected to have fallen to 45.1 from 53.0.

More PMIs will be released later in the day, this time from the US. The manufacturing index is expected to have declined to 43.0 from 50.7, while the services one is anticipated to have slid to 42.0 from 49.4.

The fact that all the PMIs are forecast to have tumbled well into the contractionary territory is not a surprise and such slumps may not prove major market movers this time around, unless the actual prints are much worse than the already very-bad forecasts. With the virus spreading extremely fast outside China during the month of March, investors are already prepared for economic consequences during the first quarter of the year. The big question is whether the wounds would get deeper during the second quarter. As we have been repeatedly noting, we do expect the damages to drag into Q2. With no vaccine ready to be distributed yet, nations are likely to maintain, and even tighten, their restrictive measures, something that inevitably may continue hurting economic activity.

As for the markets, with all that in mind we stick to our guns that equities may not have hit a bottom yet. We repeat that it would be naïve to assume that this whole turmoil is already fully priced in. Thus, we would treat any small recoveries as corrective waves before the next leg south. Safe havens like the yen, the franc and the euro, may also benefit against their risk-linked counterparts, but we expect the greenback to reclaim its throne as the FX King and probably outperform even the traditional havens yen and franc. In a leveraged world, another round of panic would likely prompt investors to liquidate positions everywhere, which, in a dollar-denominated market, means buying back dollars, in order to cover losses and margin calls.

USD/CHF — Technical Outlook

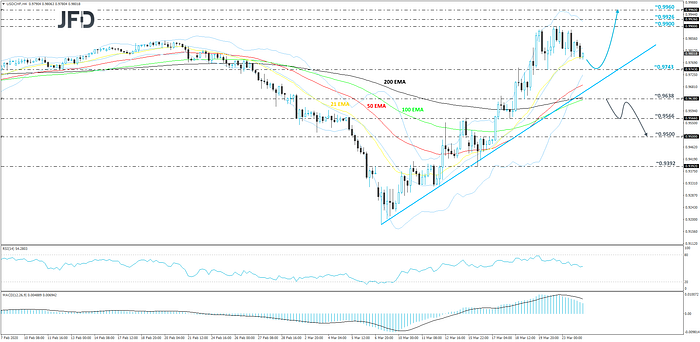

After reaching the 0.9900 barrier last week, USD/CHF got a hold-up there and corrected a bit lower. Overall, the pair still remains above its short-term tentative upside support line drawn from the lowest point of March. So, even if the rate slides a bit lower, as long as it continues to balance above that upside line, we will remain positive, at least for a while more.

For now, any move lower could still be considered as a temporary correction before another leg of buying, as long as the pair stays either above the 0.9743 hurdle, which is the low of March 20 th, or the aforementioned upside line. If so, the bulls may take charge again and drive USD/CHF to the 0.9900 zone, a break of which would confirm a forthcoming higher high. That may help the pair to pick up even more buying interest and travel to the 0.9926 obstacle, or even to the 0.9960 level, marked by the low of November 25 th, 2019.

In order to shift our attention to the downside, we will wait until USD/CHF breaks the previously-mentioned upside line and falls below the 0.9638 hurdle, which is the low of March 19 th. At the same time, the pair would be placed below its 200 EMA on the 4-hour chart, which may also be seen as a bearish indication. More sellers might join in and drive the pair to the 0.9566 hurdle, a break of which may clear the way to the 0.9500 level, marked near the intraday swing highs of March 16 thand 17 th.

Nasdaq 100 — Technical Outlook

Last week, Nasdaq 100 cash index found some decent support near the 6642 hurdle, from which it managed to climb back above the psychological 7000 mark and is now very close to testing its short-term downside resistance line taken from the high of March 5 th. If that downside line continues to hold, this may result in another round of selling. Thus, for now, we will take a cautiously-bearish approach.

As mentioned above, if the downside line continues to hold, this could lead to another slide, possibly targeting the 6848 hurdle, marked by yesterday’s intraday swing low. A break of that zone could send the index a bit lower, to the current lowest point of March, at 6642. Initially, the price might stall around there, or even rebound slightly. That said, if the buyers are still not feeling very confident, the sellers could quickly take the lead again and drive the index lower. Nasdaq 100 could bypass the 6642 obstacle, this way confirming a forthcoming lower low and may end up targeting the 6388 level, marked by the high of December 28 th, 2018.

On the other hand, if the aforementioned downside line breaks and the price gets pushed above the 7646 barrier, marked by the high of March 20 th, this may attract more bulls into the field. The index could then drift to the 7979 obstacle, a break of which might open the door for a move to the 8384 level, marked by the high of March 10 th.

As for the Rest of Today’s Events

Apart from the PMIs, we get the UK CBI industrial trend orders for March and the forecast points to a decline further into the negative territory. Specifically, this index is expected to have slid to -30 from -18 in February. The US new home sales for February are also due to be released and expectations are for a 2.3% mom decline after a 7.9% increase in January.

With regards to the energy market, the API (American Petroleum Institute) report on crude oil inventories is coming out, but as it is always the case, no forecast is available.

As for tonight, during the Asian morning Wednesday, New Zealand’s trade balance for February is due to be released, but no forecast is provided here either.

We also have one speaker on today’s schedule: St. Louis Fed President James Bullard.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Originally published at https://www.jfdbank.com on March 24, 2020.