More Brexit Votes, More Trade Talks, RBA Meeting and US NFPs

With Brexit becoming a daily sequel, it would be bizarre not to have it on the agenda this week as well. Today, UK MPs are set to hold another round of “indicative votes”, in a new attempt to break the impasse and find a viable way to move forward. With regards to the US-China saga, a Chinese delegation led by Vice Premier Liu He will travel to the US for more talks. The RBA policy meeting and the US jobs report will also be in focus, with the former perhaps exiting the non-even storage as following the RBNZ dovish tilt, investors may be eager to find out whether the Australian central bank will follow suit.

On Monday, during the European morning, Eurozone’s preliminary CPI data for March are due to be released. Expectations are for the headline rate to have held steady at +1.5% yoy, while the core one is anticipated to have ticked down to +0.9% yoy from +1.0%. That said, bearing in mind that the German CPI rate surprised to the downside on Thursday, we see the risks surrounding the bloc’s headline print as tilted to the downside.

At their latest gathering, ECB policymakers noted that the risks surrounding Eurozone’s economic outlook remain to the downside, even after they pushed back their guidance on interest rates and announced a new round of TLTROs to start in September. Thus, coming on top of the weak preliminary PMIs for March and President Draghi’s recent remarks that a hike could be delayed further, a soft set of inflation data may prompt market participants to scale back even more their hike expectations.

The bloc’s final manufacturing PMI for March is also due to be released, but as it is the case most of the times, it is expected to confirm its preliminary estimate. We get the March manufacturing PMI from the UK as well, and the consensus is for a slide to 51.2 from 52.0. Although this could add to concerns with regards to a slowdown in global manufacturing activity, among the three UK PMIs, investors tend to pay more attention to the services one, given that the service sector accounts for around 80% of the UK GDP. The services PMI is coming out on Wednesday and is forecast to slid somewhat, to 51.0 from 51.3. On Tuesday, we have the construction PMI and the consensus is for a small rise to 49.8 from 49.5.

Having said all that though, with the clock ticking towards the new Brexit date, on April 12th, and all the outcomes still on the table, from a no-deal Brexit to no Brexit at all, we believe that GBP traders are likely to keep their gaze locked on developments surrounding the political front. On Friday, PM May put half of the exit package under Parliamentary vote, hoping that a split could increase the chances of winning. Lawmakers voted only on the Withdrawal Agreement, and not the Political Declaration, but once again the result was a rejection. Today, the Parliament is set to hold another round of “indicative votes” on options over how the UK should move forward. They did that last Wednesday as well, but no proposal gained majority. Now, they are planning to narrow the options down to those that were closer to pass. According to market chatter, there is also the chance of a “run-off” vote between May’s deal and whatever alternatives gain the most popularity on Monday.

As for our view, we find it hard to envision a case where May’s deal gets approved. Even with the threat of a long delay, which could result in a softer Brexit or no Brexit at all, several hardline Brexiteers preferred to stay in the rival camp on Friday. Northern Ireland’s DUP remained adamant against the accord as well. Thus, in order to avoid a no-deal Brexit on April 12th, lawmakers would have to figure out a viable alternative, which would allow them to unlock a longer delay. Nevertheless, with hardliners noting that they prefer a no-deal divorce rather than a softer accord that keeps the UK in a customs union with the EU, agreeing on any alternative may not be an easy task. Even if they do, consent from all 27 EU member-states would still be needed.

In the US, retail sales for February are due to be released. Expectations are for headline sales to have accelerated somewhat, to +0.3% mom from +0.2%, while core sales are anticipated to have slowed to +0.4% mom from +0.9%. The final Markit manufacturing index for March, alongside the ISM manufacturing index for the month, are also due to be released. The final Markit figure is expected to confirm its preliminary print, while the ISM manufacturing index is anticipated to have remained unchanged at 54.2.

On Tuesday, during the Asian morning, the RBA decides on interest rates. When they last met, officials kept interest rates unchanged at +1.50%, and while there was no mention to the likelihood of a rate cut in the accompanying statement, the meeting minutes, released two weeks later, revealed again that members saw scenarios where interest rates could increase or decrease, with the probabilities more evenly balanced than they had been over the preceding year, when an eventual hike had appeared more likely.

Since the previous meeting, data showed that GDP slowed to +0.2 qoq in Q4 2018 from +0.3% in Q3, driving the yoy rate down to +2.3% from +2.8%, well below the Bank’s own projection of 2.75%. What’s more, the employment report revealed that the unemployment rate declined to +5.9% in February from 6.0%, but the employment change showed that the economy gained only 4.6k jobs, much less than January’s 39.1k. Given that the participation rate declined as well, we believe that the tick down in the unemployment rate may be owed to unemployed people stop looking actively for a job, instead of more people being employed.

Bearing also in mind the dovish shift by the RBNZ, which noted that its next move in interest rates is more likely to be a cut, it would be interesting to see whether the RBA will follow suit and put more weight to the cut case. According to the implied yield curve of the ASX Cash rate futures, an RBA cut is fully priced in for August this year. Thus, a dovish shift by this Bank may prompt investors to bring forth their cut bets, perhaps as early as in May, when apart from the meeting statement we will also get a press conference by Governor Lowe, as well as the quarterly Statement, which includes updated economic projections.

As for Tuesday’s data, Switzerland’s CPI for March is due to be released, and the forecast is for the yoy rate to have remained unchanged at +0.6% yoy. At their latest meeting, SNB officials downgraded further their inflation projections. They now expect the Swiss CPI to be at +1.5% yoy in Q4 2021, and this is conditional upon interest rates staying at current levels for the whole forecast horizon. Thus, even if the CPI rate ticks up, it would still be well below the Bank’s objective of 2 and is unlikely to alter policymakers’ view over monetary policy. We believe that with muted Swiss inflation, policymakers are likely to stick to their guns, keeping interest rate on hold and staying willing to intervene in the FX market if necessary.

In the US, durable goods orders for February are coming out. Headline orders are expected to have declined 1.1% mom after rising 0.3% in January, but core orders are forecast to have rebounded 0.3% mom after sliding 0.2%.

On Wednesday, Asian time, Australia’s trade balance and retail sales for February, as well as China’s Caixin services PMI for March are on the agenda. Australia’s trade surplus is expected to have narrowed, while retail sales are forecast to have accelerated somewhat, to +0.3% mom from +0.1%. China’s Caixin index is anticipated to have risen to 52.3 from 51.1, something supported by the official non-manufacturing PMI, which rose as well.

Later in the day, we have the final services and composite PMIs for March from several European nations and the Eurozone as a whole. As it is usually the case, the final prints are expected to confirm the preliminary estimates. The bloc’s retail sales for February are also due out and they are expected to have slowed to +0.2% mom from +1.3%, something that will drive the yoy rate down to +2.0% from +2.2%.

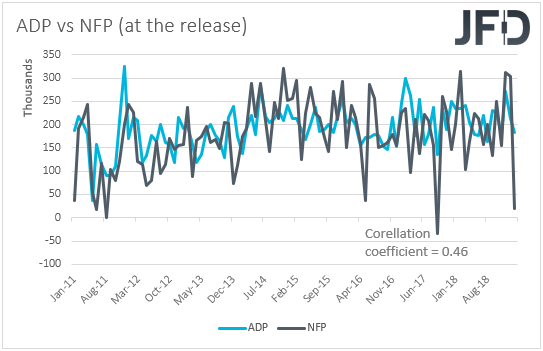

In the US, the ADP employment report for March is due to be released. Expectations are for the private sector to have gained 184k jobs, fractionally more than February’s 183k. Even though the ADP is the only major gauge we have for the non-farm payrolls, we have to repeat once again that the correlation between the two time-series at the time of the release (no revisions are taken into account), has been low in recent years. Taking into account data from January 2011, that correlation now stands at 0.46. Even in February, when the ADP showed an increase of 183k jobs, the NFP figure was a disappointing 20k.

We also get the final Markit services and composite PMIs for March, as well as the ISM non-manufacturing index for the month. As its usually the case, the final Markit prints are expected to confirm their preliminary estimates, while ISM index is expected to have declined to 58.0 from 59.7.

Apart from the data, US-China trade talks are set to resume, as a Chinese delegation led by Vice Premier Liu He is planned to visit the US. Last week’s round of negotiations ended on a positive note, with both sides reporting further progress and China approving majority-owned brokerage joint ventures for JP Morgan Chase and Japan’s Nomura, a proof of the nation’s willingness to allow more access to its financial services market. We may get similarly optimistic remarks this week, but a final and sealed accord remains unlikely. As we noted last week, the sealing of a deal is expected to happen at a meeting between US President Trump and his Chinese counterpart Xi Jinping, which according to market chatter could even be pushed back to June. So, it would be interesting to see whether these talks will allow that meeting to happen earlier than anticipated.

On Thursday, the calendar appears very light, with the only noteworthy releases being the ECB meeting minutes and Canada’s Ivey PMI for March, which is expected to have increased to 51.4 from 50.6.

With regards to the ECB minutes, we don’t expect them to prove a major market moving event. At their last gathering, the ECB officials pushed back their interest-rate forward guidance, noting that rates are likely to remain at current levels “at least through the end of 2019”, instead of “at least through the summer of 2019”, which was the case before. What’s more, they officially announced that they will launch a new series of TLTROs starting in September and ending in March 2021. At the press conference following the decision, ECB President Mario Draghi reiterated that the risk surrounding the bloc’s growth outlook are “still tilted to the downside”, even after the aforementioned policy moves and even after the Bank slashed both its GDP and inflation projections.

Thus, bearing all that in mind, we believe that the element of surprise from the minutes is very little, as there is not much new information we can get. Even if some market participants look for hints as to whether policymakers were considering to push back even more their rate guidance, we got an answer on that front from ECB President Draghi, who noted last week that the ECB could delay an interest rate hike even further if needed, warning that the risks to the bloc’s economic outlook are increasing.

On Friday, the spotlight is likely to fall on the US employment report for March. Expectations are for nonfarm payrolls to have risen 175k, following February’s disappointing increase of just 20k. The unemployment rate is forecast to have held steady at 3.8%, just a tick above its 50-year low of 3.7%, while average hourly earnings are anticipated to have slowed somewhat on a mom basis, to +0.3% from +0.4%. However, barring any revisions to the prior monthly prints, this would leave the yoy rate unchanged at +3.4%, the fastest wage growth since 2019.

Overall, the forecasts point to a decent report, in line with further tightening in the US labor market. However, we doubt that such a report will be enough to revive any bets with regards to a Fed hike this year. At its latest meeting, the FOMC downgraded its rate path projections, scraping from its “dot plot” the 2 previously-suggested rate hikes for 2019. Officials also noted that the economic activity has slowed from its solid rate in Q4 2018, prompting market participants to turn even more pessimistic with regards to the Committee’s future actions. According to the Fed funds futures, investors now see only a 42% chance for policymakers to refrain from acting this year, while there is a 58% probability for the rates to be lower. Specifically, the likelihood for one cut is at 40%, while there is a 15% chance for two quarter-point decreases. There is even a small 3% assigned to three cuts. So, having all that in mind, a decent employment report may just allow investors to take a few of their cut bets off the table.

We get March employment data from Canada as well. The unemployment rate is expected to have remained unchanged at 5.8%, but the employment change is forecast to show that the economy lost 10k jobs after gaining 55.9k in February. Despite the upside surprise in February’s inflation data and the better than expected GDP for January, a weak employment report could add some credence to BoC policymakers’ choice to turn dovish at their latest meeting. At that gathering, they altered their view for more rate increases over time and noted that “the outlook continues to warrant a policy interest rate that is below its neutral range”. They also highlighted the uncertainty surrounding the timing of their future actions. Thus, even if the inflation and GDP data is pleasant news for them, we still believe that they would like to see more improvement before they get confident on further rate increases again.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.

Originally published at www.jfdbank.com.