Texas Freeze Supports Oil, GBP-Traders Await Inflation Data

Market sentiment continued to improve yesterday and today in Asia, with the oil-related currencies NOK and CAD being the main gainers among the G10s as a severe snow storm in the US increased oil demand and threatened production in Texas. GBP was also among the winners, with its traders awaiting the UK CPIs for January, scheduled to be released tomorrow, during the early European morning.

Oil Rallies due to Snow Storm, UK CPIs on Tomorrow’s Agenda

The US dollar traded lower or unchanged against all but one of the other G10 currencies on Monday and during the Asian session Tuesday. It gained only versus JPY, while it underperformed against NOK, CAD, GBP and CHF in that order. The greenback was found virtually unchanged against EUR, AUD, NZD, and SEK.

The weakening of the safe-haven JPY and the strengthening of the oil-related NOK and CAD suggest that markets continued trading in a risk-on manner yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that major EU indices were a sea of green, with the positive investor morale rolling into the Asian session today. US markets stayed shut due to the President’s Day, while China’s Shanghai Composite will be closed until Thursday due to the celebrations of the Lunar New Year.

The further improvement in market appetite is in line with our broader view. Remember that, recently, we’ve been repeatedly highlighting that the covid vaccinations, the monetary policy support around the globe, and a large fiscal package in the US, are a blend of developments which could keep the overall investor morale supported. We believe that these are still the main market drivers and thus, we will stick to our guns. Anticipation of more US fiscal stimulus was bolstered even further on Friday, after President Joe Biden turned to a bipartisan group of local officials for help on its USD 1.9trln relief plan.

Among the G10 currencies, NOK and CAD were the main winners and this may have been due to the stellar gains in oil prices. Apart from the overall risk-on environment, oil prices may have been boosted by a severe snow storm in the United states, with the deep freeze, not only increasing power demand, but also threatening oil production in Texas. Around 4.6mn barrels per day are produced in Texas, which is also the home of 31 refineries, the most across the whole US, according to data from the Energy Information Administration. Thus, alongside an improved market appetite, supply concerns with regards to the biggest producing state of the world’s largest oil producing nation may keep prices of the “black gold” supported for a while more, and thereby, NOK and CAD may continue to gain, especially against the safe havens, like the yen.

The pound was also among the gainers against the greenback, but with no clear catalyst behind its gains. The next scheduled event traders of this currency are likely to pay attention to is the release of the UK CPIs for January, due out tomorrow, during the early European morning. Both the headline and core rates are expected to have ticked down to +0.5% yoy and +1.3% yoy, from +0.6% and +1.4% respectively. Although such prints will keep the door open for an increase in the BoE’s QE purchases if deemed necessary, we don’t expect them to hurt the pound much. At its latest gathering, the BoE pushed back the idea of negative interest rates, which combined with the fact that the UK is going further ahead in the covid vaccination race, encouraged GBP-traders to buy more of the British currency. In our view, the same catalysts are likely to continue supporting the pound.

Brent Oil — Technical Outlook

Brent Oil continues to drift north, after reversing higher from a severe fall in March and April 2020. The commodity is currently balancing above a short-term tentative upside support line taken from the low of February 1st. That said, after finding resistance near the 63.82 zone on Friday, the “black gold”, so far is finding it hard to overcome that obstacle. Given the steep upmove we already saw in the recent day days, there might be a chance to see a small correction lower before another possible leg of buying, that is, of course, if the price remains somewhere above that upside line. Hence our cautiously-bullish approach for now.

If Brent oil drifts back down, but finds good support somewhere between the 62.90 and 63.12 levels, marked by the high of February 12th and the low of February 15th respectively, that could help the bulls to get back in the game again. The commodity might rise back to the previously mentioned 63.82 barrier, a break of which would confirm a forthcoming higher high, possibly setting the stage for further advances. We will then aim for the 64.31 hurdle, or even the 65.32 level, marked by the high of September 20th, 2019.

On the downside, if the price breaks the aforementioned upside line and also falls below the 61.78 area, marked by the high of February 10th, that could change the direction of the current trend, potentially opening the door for further declines. We will then aim for the area between the 60.15 and 60.46 levels, marked by the lows of February 9th and 12th respectively. If the selling doesn’t stop there, the next aim could be at 59.20, which is near the high of February 4th and near the low of February 5th.

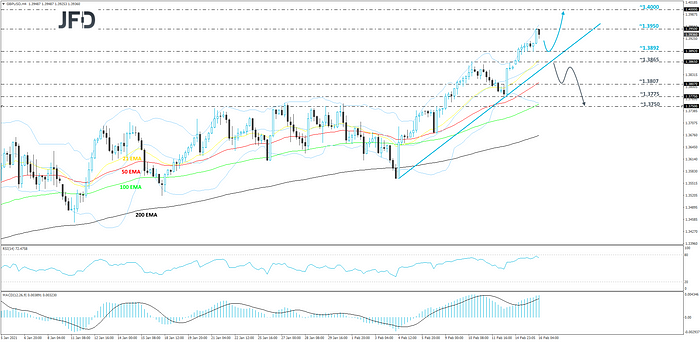

GBP/USD — Technical Outlook

GBP/USD is still seen moving to the upside, but from the beginning of February, the pair’s uprise became even steeper. The rate is currently balancing above a short-term tentative upside support line taken from the low of February 4th. This morning, GBP/USD found strong resistance near the 1.3950 barrier and corrected back down from there. If the pair struggles to overcome the 1.3950 hurdle straight away, we may see a larger correction lower. That said, as long as the rate remains above that upside line, we will stay positive with the near-term outlook.

A larger correction lower might bring GBP/USD to the 1.3892 hurdle, marked by yesterday’s intraday swing low, or to the aforementioned upside line, which may provide additional support. If that whole area holds, the rate could rebound back up, possibly targeting the 1.3950 barrier again. If this time that barrier gets broken, this will confirm a forthcoming higher high and the next aim might be at the psychological 1.4000 mark, which is the high of April 26th, 2018.

Alternatively, if the previously-mentioned upside line breaks and the rate falls below the 1.3865 zone, marked by the high of February 10th, that may spook the buyers from the arena for a while. More sellers could join in and drive the pair to the 1.3807 obstacle, or even the 1.3775 area, marked by the low of February 12th. That area might provide an initial hold-up, however, if the bears are still feeling comfortable, the next possible target may be at 1.3750, which is the high of February 8th.

As for Today’s Events

During the European trading, we get the German ZEW survey for February, the 2nd estimate of Eurozone’s GDP for Q4, as well as the bloc’s preliminary employment change for the quarter. With regards to the ZEW survey, the current conditions index is expected to have declined to -67.0 from -66.4, while the economic sentiment index is forecast to have fallen to 59.5 from 61.8. The 2nd estimate of Eurozone’s GDP is anticipated to confirm its preliminary estimate of -0.7% qoq, while no forecast is available for the employment change. Later, from the US, we have the New York Empire State manufacturing index for February.

We also have two Fed speakers on today’s agenda and those are San Francisco President Mary Daly and Board Governor Michelle Bowman.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.07% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2021 JFD Group Ltd.

Originally published at https://www.jfdbank.com.