Trump Asks for a Draft Trade Deal, US Jobs Report in Focus

Markets continued trading in a risk-on mode yesterday, with US President Trump saying that he had a good conversation with China’s President, and reports suggesting that he asked Cabinet to prepare a draft trade deal with China. In the UK, the BoE made no policy changes, but Governor Carney said that policy could move in either direction in case of a no-deal Brexit. As for today, the spotlight is likely to fall on the US employment data for October.

Trump Seeks a Deal with China, BoE Could Still Hike in Case of No Brexit Deal

The dollar traded lower against all but one of the other G10 currencies on Thursday. The only currency against which the dollar did not underperform, and instead traded virtually unchanged, was JPY. The main gainers were the commodity-linked currencies AUD and NZD, with GBP sitting in the third place.

The pattern suggests that risk appetite was boosted again yesterday. Indeed, most major EU and all the US equity indices closed their sessions in positive territory once again. This rolled over into the Asian markets today, with Japan’s Nikkei 225 and China’s Shanghai Composite ending 2.63% and 2.70% up respectively.

Once again, the driving force were headlines surrounding the US-China trade standoff. Around half an hour after the US opening bell, US President Trump tweeted that he had a very good conversation with his Chinese counterpart Xi Jinping and that the discussions are “moving along nicely”. The news revived hopes that the two countries can find common ground on trade and encouraged more investors to abandon safe-haven assets, like the yen, in favour of more risky ones, like the Aussie and Kiwi, as well as equities.

The icing on the cake though came overnight. Headlines suggested that President Trump has asked key Cabinet Secretaries to prepare a draft trade deal with China, a move signalling his willingness to reach an agreement with President Xi at the G20 summit in Buenos Aires later this month. This added more fuel to the positive sentiment that dominated the day yesterday.

The pound was also among the main gainers against the dollar. Although it did not react much to the BoE decision, the British currency remained well supported by hopes over a Brexit deal. Following the reports that the UK and the EU have struck a tentative deal on financial services, another report yesterday said that the EU is exploring a compromise on an Irish border plan. Despite remarks by Theresa May’s spokesman that the reports over a services deal were speculation, the latest report kept GBP-bulls in the driver’s seat.

As for the BoE, the Bank kept interest rates unchanged via a 9–0 vote, as was widely anticipated, and repeated that an ongoing tightening would be appropriate, with any further rate increases likely to be at a gradual pace and to a limited extent. In the quarterly Inflation report, officials noted that the rate path implied by market prices has risen since August. The benchmark rate is now seen at 1.4% in Q3 2021, compared to 1.1% in the August report. At the press conference, Governor Carney said that the nature of the UK’s departure from the EU is not known at present and that the Bank’s response will not be automatic. It could be in either direction, the Governor said, signalling that rates could go up even in case of a no-deal Brexit.

In our view, the meeting had a somewhat hawkish flavour, something that did not prevent the pound from keep strengthening. That said, we still believe that any policy action is more likely to come after the official Brexit date, which is on the 29thof March 2019. The Bank would have to assess the implications of the divorce and we agree that policy could move in either direction even in case of a no-deal outcome. Although such an outcome could hit growth, a potential tumble in the pound could push inflation up again. The Bank would have to assess the possible trade-off and if bringing inflation back down to target appears more urgent than balancing the hit to growth, then it may decide to hike. If the opposite is the case, a rate cut may be appropriate.

Nasdaq 100 Cash — Technical Outlook

Yesterday, we saw the Nasdaq 100 cash index breaking through its short-term downside resistance line drawn from the peak of the 3rdof October. It looks like for now, the index could continue its uprise until it finds a strong resistance level that could hold it down.

The Nasdaq 100 cash index has broken yesterday’s high near the 7070 barrier, which now opens the path towards the next potential area of resistance at 7160 that held the rate down on the on the 24thof October. If that doesn’t slow down the bulls, then a further acceleration of the price could lead towards the 7230 hurdle, a break of which may clear the way towards the 7352 obstacle, which was the high of the 17thof October.

Looking at our 4-hour chart, the RSI and the MACD are supporting the idea of a further uprise, as the RSI is above 50 and points higher. The MACD also looks quite promising, as it is in the positive territory, remains above the trigger line and is also showing the upwards direction.

Alternatively, if the index decides to drop below the previously-mentioned downside resistance line and closes below the 6925 level, this could alert the bulls to let go of the steering wheel. This is where more bears could jump into the action and drive Nasdaq 100 down towards the 6860 obstacle, a break of which may open the way towards the psychological 6800 area, marked by the inside swing high of the 30thof October. If that doesn’t stop the sellers, a further decline may drag the index towards the next psychological zone of 6700, which also acted as good support on the 29thof October.

US Employment Data Take Center Stage

As for today, the spotlight is likely to fall on US employment data for October. Expectations are for non-farm payrolls to have increased 191k, after rising 134k in September. The unemployment rate is forecast to have stayed unchanged at 3.7%, its lowest since 1969, while average hourly earnings are expected to have slowed to +0.2% mom from +0.3%. Nevertheless, this could drive the yoy rate up to +3.1% from +2.8%.

Overall, the forecasts point to a further tightening of the labour market and barring any major deviations from the NFP forecast, we believe that most of the attention is likely to fall once again on wage growth. Accelerating earnings on a yearly basis could mean accelerating inflation in the months to come. The key takeaway we got from the latest FOMC meeting, as well as the minutes of that gathering, is that Fed officials are willing to continue raising rates mainly guided by economic data, instead of how close to their neutral level interest rates are. What’s more, some of them believe that it would be necessary to raise rates above neutral for some time.

According to the Fed Funds, the market assigns a 70% chance to a December hike, and anticipates nearly two more for 2019, at a time when Fed officials expect three. This suggests that there is room for market participants to bring their estimates closer to the Fed’s if data continue to come on the positive side, and a decent employment report may encourage them to do so. This could bring the dollar under buying interest. That said, fears that the Fed may continue raising rates faster than previously anticipated was one of the drivers behind the recent equity turbulence. So, although encouraging data may support the dollar, accelerating wages could hurt equities. However, given the upbeat sentiment surrounding the US-China trade conflict, we don’t expect a major tumble. We would treat such a setback as a corrective move.

USD/JPY — Technical Outlook

Overall, USD/JPY continues to climb higher and is still trading above its medium-term upside support line drawn from the low of the 29thof May. As long as that line remains intact, we will remain bullish over the near-term. We can see that USD/JPY is trying now to recover its losses from the month of October.

At the time of this analysis, USD/JPY is sitting slightly below the 113.00 level that held the rate down yesterday. If the pair gets a strong push above it, then we could easily target the 113.35 area, a break of which could invite more bulls to join in. Such a move could raise more confidence among buyers and USD/JPY could get lifted a bit higher towards the 113.55 obstacle, which acted as good support on the 5thand around the 2ndof October. If this level does not stop the bulls from advancing, a further move higher could test the 113.95 zone, marked by the high of the 8thof October.

On the downside, if USD/JPY drops below the 112.56 hurdle, which was yesterday’s low, this could caution the bulls. The bears could try and push the pair lower towards the next potential area of support at 112.20, a break of which could set the stage for a further decline to test the 111.80 barrier. This barrier marks the low near the 29thof October. If the pair continues its path south, this is where the aforementioned upside support line could come into play, as it could limit the downside. At the same time, the 111.37 level could get tested, as it marks the low of the low of the 26thof October.

As for the Rest of Today’s Events

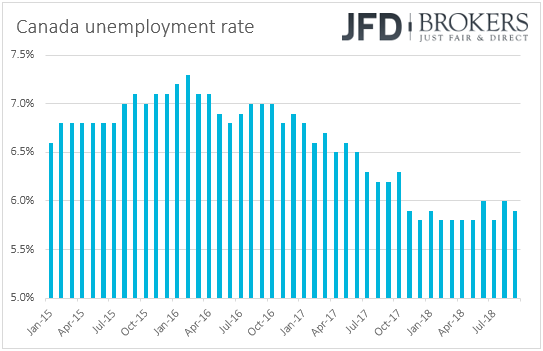

Besides the US employment report, we get jobs data for October from Canada as well. The forecasts suggest that the unemployment rate remained unchanged at 5.9% with the economy gaining 10k more jobs after the stellar 63.3k gain in August. At its policy meeting last week, the BoC raised rates by 25bps to +1.75% and removed the part saying that officials will “take a gradual approach” with regards to future rate increases. Instead, they simply noted that “In determining the appropriate pace of rate increases, the Governing Council will continue to take into account how the economy is adjusting to higher interest rates”. Therefore, a decent employment report could keep bets for further and faster rate increases elevated.

In Europe, we get the final manufacturing PMIs from several European nations and the Eurozone as a whole. As usual, the bloc’s final print is expected to confirm its preliminary estimate, which showed a slide to 52.1 from 53.2. In the UK, the construction PMI for October is anticipated to have ticked down to 52.0 from 52.1. From the US, besides the employment data, we get factory orders and trade data, both for September. We get trade data for September from Canada as well.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Originally published at www.jfdbrokers.com.