UK MPs Take Control of Brexit for a Day, RBNZ Decides on Rates

The pound came under selling interest on Monday but rebounded somewhat overnight, after UK MPs took control over the Brexit process for a day. That said, the gains were not enough to recover the previously lost ground. As for tonight, during the Asian morning Wednesday, the RBNZ decides on monetary policy, with investors perhaps eager to find out whether Governor Orr will stick to his guns and note that the next move in interest rates could be either up or down.

GBP Down on Brexit Uncertainty, Rebounds Slightly After MPs Vote

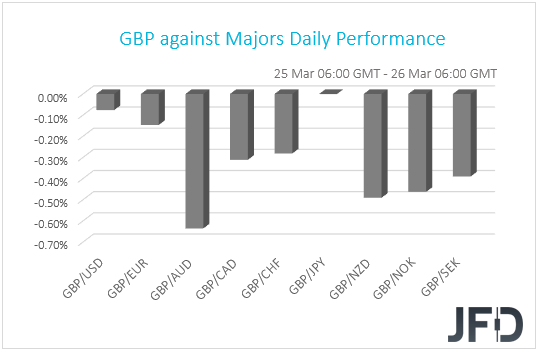

The pound traded lower against all but one of the other G10 currencies on Monday. It lost the most ground against AUD, NZD and NOK in that order, while the currency that failed to capitalize against GBP was JPY.

As we noted several times in the recent past, the only driver in town for the British currency is Brexit. On Friday, sterling traded higher after EU leaders agreed to offer the UK an unconditional extension up until April 12th. However, the currency took a 180-degree spin on Monday following reports that a third “meaningful vote” may not take place this week. While addressing the UK Parliament, the Prime Minister herself noted that there is not enough support for the withdrawal agreement and thus a vote will not take place on Tuesday. However, she did not rule out putting her deal back on the table later this week, with market chatter suggesting that Thursday appears the most likely day.

The pound rebounded somewhat overnight, but that was not enough to recover all the previously recorded losses and bring the currency in a winner’s position. The trigger behind the modest rebound was lawmakers’ positive vote to an amendment that gives them control over the Brexit process for a day, on March 27th. On Wednesday, lawmakers will debate alternative ways on how the UK could move forward, and perhaps hold “indicative votes” that could push the government in the chosen path. Nonetheless, the results will not be legally binding. May has already made clear that she will not follow through with a proposal that is against her election manifesto.

In our view, the picture has not become any brighter and perhaps many investors agree with us, if we judge by the muted gains in the pound after the approval of the aforementioned amendment. The government is not obligated to abide by lawmakers’ decisions, while the chances of her deal being approved remain slim. On Sunday, the Sun newspaper said that May could step down if that’s what it takes for her party to vote in favor of the deal. Some Conservative MPs have already publicly called her to do so.

With the clock ticking towards the new Brexit date, which is April 12th, there is no clear plan on how to move forward. In order for that date to be pushed back to May 22nd, May’s deal needs to be approved. Otherwise, the UK will have to decide whether to exit without a treaty, or present a clear plan on how to move forward, something that would require a longer extension and obligate the nation to participate in the European parliamentary elections. Still, consent from all EU 27 members could be needed. All of them would have to judge any alternative plan as credible before a longer delay takes flesh.

Thus, with all options sill on the table, from a no-deal Brexit to no Brexit at all, it’s hard to say with confidence where the pound may be headed next. We expect the currency to remain headline-driven, with anything suggesting that a disorderly withdrawal is becoming less likely having the potential to support the currency, and vice versa.

GBP/USD — Technical Outlook

On March 21st, GBP/USD re-visited its upside support line taken from the low of January 3rd, but then quickly travelled back up. That said, the pair was still not able to overcome its short-term downside resistance line drawn from the high of March 13th, which means that GBP/USD is showing signs of coiling up. For now, we will remain somewhat neutral, as the pair might move sideways for now. Also, on the fundamental side, the Brexit outcome remains unknown, which means that GBP/USD could stay headline-driven for a while.

A push below yesterday’s support, at 1.3160, could force the pair to slide a bit further, initially targeting the 200 EMA and then, potentially the 1.3110 obstacle. If the bears remain behind the steering wheel, then they might totally ignore that obstacle and continue applying pressure on the rate, which may depreciate further. This is when GBP/USD could move lower towards the 1.3050 hurdle, which on March 12th held the rate from traveling lower. This is also where the pair might meet its previously-discussed upside support line and test it again.

On the other hand, if the aforementioned downside resistance line fails to hold the rate down, a push above it and the 1.3225 barrier, marked by Friday’s high, could invite more buyers into the game. Such a move might lead GBP/USD to the 1.3300 level, which acted as good resistance on March 17th and 19th. If this time that level is not seen as a strong obstacle on the pair’s way higher, a break of it could open the door to the 1.3350 area, or even the 1.3380 zone. The last one marks the peak of March 13th.

RBNZ Decides on Interest Rates

Following the Fed, the BoE, the SNB and the Norges Bank decisions last week, during the Asian morning Wednesday, the central bank torch will be passed to the RBNZ. This would be one of the “smaller” meetings that are not accompanied by updated economic projections, neither a press conference by Governor Adrian Orr. Therefore, if the Bank holds off from acting on rates as it is widely expected, all the attention is likely to fall on the meeting statement.

At the February meeting, the Bank maintained interest rates unchanged at +1.75%, while in the accompanying statement, Governor Orr reiterated that rates are expected to stay at this level through 2019 and 2020, bringing back the part saying that the direction of the next move could be either up or down. What’s more, in the quarterly Monetary Policy Statement, officials pushed back the timing of when they expect interest rates to start rising, from Q3 2020 to Q1 2021. A 25bps rate increase is now seen in Q2 of 2021.

Since then, the only top tier data we got was the Q4 GDP. The qoq growth rate came in line with market consensus of +0.6%, which is double than the +0.3% for Q3. Although the Kiwi gained at the time of the release, a +0.6% growth rate is below the Bank’s own forecast for the last quarter of 2018, which is at +0.8% qoq. Yes, the Bank could acknowledge the better-than-previously economic performance, but it is unlikely to alter its broader view with regards to future policy actions. We expect Governor Orr to stick to his guns and point that the “next OCR move could be up or down.”

NZD/CAD — Technical Outlook

During this month, NZD/CAD showed some good performance, where the pair travelled north and managed to gain around 300 pips. That said, it looks like the bulls are running out of steam, as the rate could be positioning itself for a small retracement back down. The pair continues to trade above its short-term upside support line taken from the low of February 28th but given that it has distanced itself from that line, we may see a small correction back down first, before the bulls could re-enter the field.

A move lower and a drop below the 0.9220 hurdle may open the door to the pair’s next potential support zone, at 0.9190, marked near the low of March 22nd and near the high of March 12th. We might see a small correction back up again, but if the bears are still on the stronger side, the rebound may be short-lived, and the selling could resume. A break below the 0.9190 area may lead the rate to test the aforementioned upside line, or even the 0.9159 support zone, which on March 18th acted as good resistance for the pair.

In order to aim towards slightly higher levels, we would first like to see a push above yesterday’s high, at 0.9281 barrier. This way, the pair would confirm a forthcoming higher high and potentially drag itself to the 0.9304 obstacle, a break of which could keep the rate acceleration still present. If the bears are nowhere in sight, a break above the 0.9304 area might clear the path to the 0.9337, which marks the high of April 9th, 2018.

As for Today’s Events

From the US, we get building permits and housing starts both for February, as well as the Conference Board consumer confidence index for March. Building permits are forecast to have fallen 1.3% mom after rising 1.4% in January. Housing starts are also expected to have slid (-0.8% mom from +18.6). As far as the CB index is concerned, consensus is for a rise to 132.0 from 131.4.

With regards to the energy market, we have the API (American Petroleum Institute) weekly report on crude oil inventories, but as it is always the case, no forecast is available.

As for the speakers, there are 5 on the agenda: From the Fed, we have Philadelphia President Patrick Harker, Chicago President Charles Evans, and San Francisco President Mary Daly. From the BoE, Deputy Governor Ben Broadbent will step up to the rostrum, while tonight, during the Asian morning Wednesday, RBA’s Assistant Governor Christopher Kent will speak.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.

Originally published at www.jfdbank.com.