US Bans Russian Oil, EUR Gains Ahead of Tomorrow’s ECB Decision

Equities came under some additional pressure yesterday and today in Asia, after US Pr. Biden announced a ban on Russian oil. The euro gained however, perhaps lifted by sovereign bond yields, but with the ECB decision looming, we are reluctant to call for more recovery.

EQUITIES SLIDE ON US BAN ON RUSSIAN OIL, EUR HIGHER BUT ECB LOOMS

The US dollar continued trading higher against most of the other major currencies on Tuesday and during the Asian Wednesday. It lost ground only versus EUR, while it was found virtually unchanged against GBP.

At first glance, the strengthening of the US dollar suggests that the financial world continued trading in a risk-off manner. However, the rebound in the euro, the stabilization of the pound, and the weakening of the Canadian dollar, make the picture blurrier. Remember that the crisis in Ukraine has been negative for the euro and the pound, but positive for the oil-linked Loonie.

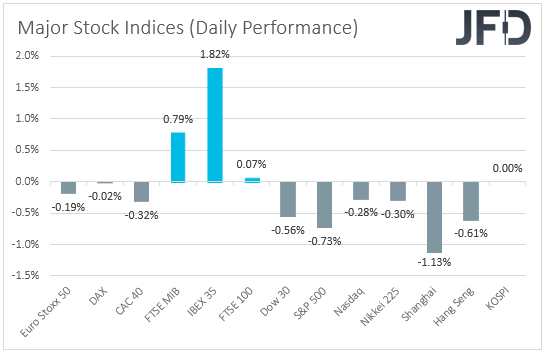

Turning our gaze to the equity world, we see that major EU indices traded mixed, with appetite softening somewhat more during the US session, and even more in Asia today. At a time when investors seem to have decided to take a breather from the massive selling of the previous days, US President Joe Bide announced a US ban on Russian oil and other energy imports, and that’s maybe why we saw some further selling yesterday and today in Asia. The EU has yet to proceed with similar actions, perhaps due to its large dependence on Russian gas and oil.

But, if the crisis between Russia and Ukraine is still a reason for investors to sell equities, why did the euro gain this time around? Maybe it was lifted by Eurozone sovereign bond yields, which soared after reports that the European Union plans as soon as this week to issue bonds on a massive scale to finance energy and defense spending.

That said, with the ECB scheduled to announce its monetary policy decision tomorrow, we are very reluctant to call for more recovery in the common currency. Actually, despite inflation in the bloc expected to accelerate further, there are fears that the geopolitical developments in Ukraine could well harm Europe’s economic performance. Therefore, we expect officials to sound more dovish than they did last time, perhaps hinting that a rate hike may be delayed, and even pushed into next year. This could bring the euro back under renewed selling interest.

Overall, we stick to our guns that the ongoing geopolitical crisis will keep the path of least resistance for equities, the euro and the pound, to the downside. At the same time, the US dollar and other safe havens, like the yen, are likely to continue receiving support, while the commodity-linked currencies Aussie, Kiwi and Loonie, could rebound again soon if energy and other commodity prices continue to skyrocket.

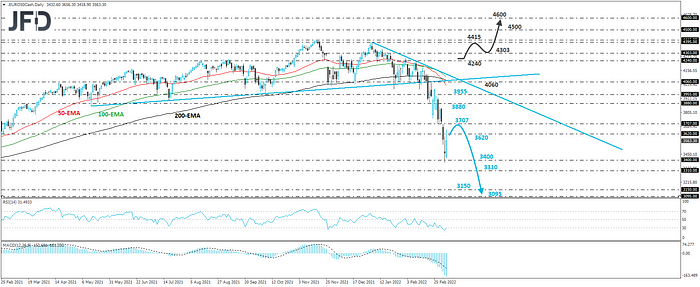

EURO STOXX 50 — TECHNICAL OUTLOOK

The Euro Stoxx cash index traded higher yesterday, after it hit support near the 3400 zone on Monday. However, it remains well below both the prior upside line taken from the low of May 13th and the downside one drawn from the peak of January 5th, and thus, we will consider the recovery as a corrective bounce. We still believe that the near-term outlook is negative.

Even if the recovery continues for a while more, we would expect the bears to jump back into the action from near the 3707 barrier, or even higher. As long as it is below the downside line taken from the peak of January 5th. This may result in another slide near the 3400, where a break would confirm a forthcoming lower low and may initially target the 3310 barrier, marked by the inside swing high of October 13th, 2020. If that barrier doesn’t hold either, then we are likely to see extensions towards the 3150 or 3095 supports, with the latter defined by the low of September 25th.

Now, in order to consider that the bulls have gained back full control, we would like to see a recovery all the way back above 4240. The index will be decently above both the aforementioned diagonal lines and may initially target the 4303 zone, marked by the high of January 20th. Another break, above that level, could aim for the peak of November 18th, at 4415. If participants are not willing to stop there, by breaking higher, they will enter territories last tested in December 2017. The next territories to consider as resistances may be the 4500 and 4600 areas.

EUR/JPY — TECHNICAL OUTLOOK

EUR/JPY has been trading in a recovery mode since Monday, when it hit support at 124.40. However, yesterday, the rate hit resistance at 126.75, still below the downside resistance line drawn from the high of February 10th. With that in mind, we will consider the recovery as a corrective move, and the broader short-term path to be still negative.

We believe that the bears will take charge again soon and push the action back below the 125.95 barrier, marked by the inside swing high of March 7th. This may result in a slide back near the 124.40 zone, the break of which would confirm a forthcoming lower low and may carry extensions towards the low of November 19th, at 122.85.

We will start considering a short-term bullish reversal upon a break above 128.75, the high of March 2nd. This will confirm a forthcoming higher high and may initially see scope for advances towards the peak of February 25th, at 130.28, or the high of February 22nd, at 130.75. A break higher could set the stage for extensions towards the peak of February 16th, at 131.90.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.82% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2022 JFD Group Ltd.

Originally published at https://www.jfdbank.com.