USD Mixed Ahead of Fed Minutes, GBP Up and Down on May’s New Offer

The US dollar traded mixed yesterday, with risk appetite staying supported during the EU and US sessions, perhaps due to the US government’s decision to ease restrictions imposed on Huawei. Today, USD-traders may pay some attention to the FOMC minutes but bearing in mind that the latest trade tensions may have affected policymakers’ views, the information we get may be outdated. The pound surged following headlines that PM May will include a vote over a second referendum in her new offer, but the currency erased those gains as lawmakers remained opposed.

Risk Sentiment Stays Supported, FOMC Releases Minutes

The dollar traded mixed against the other G10 currencies on Tuesday and during the Asian morning Wednesday. It gained against JPY, NZD, CHF and GBP in that order, while it underperformed versus NOK, SEK and CAD. The greenback was found virtually unchanged against AUD and EUR.

The weakening of both the safe-havens JPY and CHF suggests that market sentiment may have remained supported yesterday. Indeed, after the recovery in investor morale during the Asian session, major EU and US bourses were a sea of green. As for today’s Asian trading, equity indices were mixed, with Japan’s Nikkei 225 and China’s Shanghai Composite closing 0.05% up and 0.49% down respectively.

It seems that the US government’s decision to temporarily ease restrictions imposed on Huawei allowed some more risk-on trading, at least during the EU and US sessions. However, despite the performance of the equity world yesterday, we are still skeptical over a long-lasting recovery. Before we get confident on that front, we would like to see concrete signs that both the US and China are truly willing find common ground. Such sings could be the dates and place of the next round of negotiations, or even better, the removal of some of the existing tariffs, which appears highly unlikely for now given that the US could still tax the remaining goods it imports from China.

As for the dollar, the path of least resistance appears to be to the upside, despite the increasing bets over a Fed rate cut by the end of the year due to the latest US-China trade tensions. It seems that, during periods of uncertainty, market participants prefer to look for safety in the greenback. Perhaps they believe that the US economy has more chances than other economies to withstand a trade war, and this is evident by US economic data. On the other hand, when risk aversion eases, the probability for a Fed cut declines as the chances for the economy to perform even better in the future increase. This is also positive for the dollar we believe.

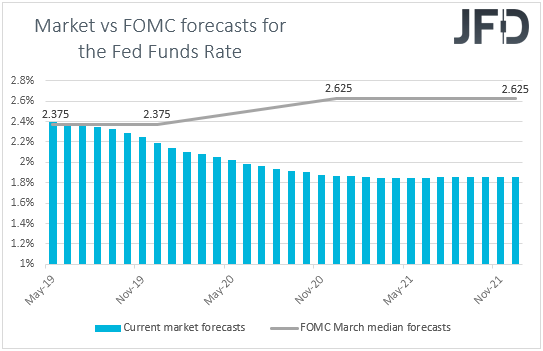

As for today, USD traders may prefer to pay some attention to the minutes of the latest FOMC gathering. At that meeting, the Committee decided to keep interest rates unchanged as was widely anticipated, reiterating its “patient” stance with regards to future adjustments to the target range. Officials also noted that “inflation and inflation for items other than food and energy have declined and are running below 2%”, which triggered a slide in the US dollar, perhaps due to increasing bets that officials may eventually decide to hit the cut button by the end of the year.

That said, at the press conference following the decision, Fed Chief Powell noted that some transitory factors may be at work with low inflation and that there is no strong case for moving in either direction. So, having that in mind, we will scan the minutes to see whether the other members, or at least the majority of them, were on the same page with Powell, or not. However, even if they were, that information may be outdated, as the meeting took place ahead of the latest escalation in trade tensions between China and the US. As we already noted, the spat prompted investors to increase notably their cut bets, even if they reduced them somewhat yesterday. According to the Fed funds futures, the probability for interest rates to be lower by year-end is now standing at 68%, while a month ago, that percentage was 50%. On Monday, the number was even higher, at 73%.

NZD/USD — Technical Outlook

NZD/USD still trades below its short-term downside resistance line taken from the high of March 26 th. After finding good support near the 0.6500 hurdle yesterday, today, the pair is already breaking below it, which adds a negative spin on the near-term outlook and forces us to take a bearish stand, at least for now.

The break of the 0.6500 hurdle is confirming now a forthcoming lower low, which might lead the pair towards the 0.6465 zone, marked by the low of October 26 th. Given that NZD/USD is already quite oversold on the shorter timeframes, the rate might bounce back up for a bit of correction, but if it continues to run below that short-term downside line, the bears could step in again and take control of the steering wheel. This may lead to another slide, bringing the pair back to the 0.6465 obstacle, a break of which could send NZD/USD further down, potentially aiming for the 0.6440 area, which is the low of October 10 th.

Alternatively, if the aforementioned downside line fails to hold the rate down, its break could make the bears worry about their chances of pushing the pair lower in the short run. But, in order to get more comfortable with a short-term reversal, we would like to see NZD/USD climbing above the 0.6547 barrier, marked by Monday’s high. This might invite more buyers into the game and send the rate to the May 16 thhigh, at 0.6580. If the buying doesn’t end there, a break above the 0.6580 barrier may lift the rate to the 0.6613 level, which held the rate down on May 10 th.

GBP Trades in a Rollercoaster Mode on May’s New Brexit Offer

The pound was found slightly lower against the greenback, but the ride was not a smooth one. The British currency surged following headlines that UK PM Theresa May will include a requirement for MPs to vote on whether to hold a second referendum. That said, when May spoke, she said that a second referendum would be conditional upon the bill passing through Parliament at a first voting stage. She also pledged to allow lawmakers to vote over a type of customs arrangements with the EU.

It seems that her plan did not go as she expected, as her offer over customs arrangements infuriated hardliners, while others hardened their position as well. Even Labour Leader Jeremy Corbyn, who supports a public vote, said that his party could not vote for such a deal, adding that the new offer was “largely a rehash of the government’s position” in the cross-party talks that collapsed last week. Perhaps Corbyn disagrees with Parliament agreeing on the deal first, before passing the ball to the public. Northern Ireland’s DUP also opposed May’s proposal, saying that the “fatal flaws” of the original deal remain.

The pound was quick to reverse the aforementioned gains following lawmakers’ dissatisfaction with May’s new offer, as it seems we are back to square one. The withdrawal agreement is set for a fourth defeat in Parliament, which could increase pressure on May to resign sooner rather than later. With the front-runner among her potential replacements being Boris Johnson, a hardline Brexiteer, the probability for a no-deal divorce remains decent in our view.

Today, we get the UK CPIs for April, but having all the above in mind, we doubt that this data could prove determinant with regards to the pound’s fortune. Just for the record, both the headline and core rates are expected to have risen to +2.2% yoy and 1.9% yoy, from +1.9% and +1.8% respectively. Under normal circumstances, this would have probably encouraged market participants to bring forth their expectations with regard to a BoE rate hike. That said, with the Bank’s hands tied until the Brexit riddle is solved, we don’t expect any major reaction. We stick to our guns that the pound is destined to stay anchored to headlines surrounding the political scene, and without any signs of a breakthrough, we believe that the currency could stay pressured.

GBP/CAD — Technical Outlook

GBP/CAD continues to trade below its short-term downside resistance line drawn from the high of May 6 th. Yesterday, the pair found good support near the 1.7020 zone, from which it also spiked higher on headlines over Theresa May’s Brexit deal proposal. But the spike was short-lived and the rate moved back down to the same zone, from which it bounced. For now, it looks like the 1.7020 area continues to hold, which may lead to another temporary correction to the upside. But as long as the above-mentioned downside line remains intact, we will remain sceptical about any further extensions to the upside.

As discussed above, there is a chance to see GBP/CAD moving back up a bit to test some of the higher resistance areas, like the 1.7140 hurdle, marked by Monday’s high. Slightly higher sits yesterday’ high, at 1.7180, which could also provide some additional resistance and might help to keep the rate down. If the pair struggles to continue pushing higher, this could be an opportunity for the bears to step in again and drive GBP/CAD back down, initially aiming for the 1.7020 hurdle, a break of which could send the rate a bit lower. This is when we may see a test of the 1.6973 zone, marked by the low of February 14 th.

On the other hand, in order to consider larger extensions to the upside, we would like to see GBP/CAD breaking, not only the aforementioned downside line, but also pushing above the 1.7245 barrier, marked by the high of May 17 th. If the rate acceleration continues, the pair might test the 1.7315 obstacle, which acted as a strong support area on April 17 thand 22 nd. GBP/CAD could temporarily stall around there, or even retrace slightly lower. But if the bulls still have the upper hand, they might take advantage of any throwback and push the rate higher again, potentially bypassing the 1.7315 hurdle and aiming for the 1.7415 level, which is the high of May 15 th.

As for the Rest of Today’s Events

From Canada, we get retail sales for March. Expectations are for both headline and core sales to have accelerated. Specifically, the headline rate is forecast to have risen to +1.0% mom from +0.8%, while the core one is anticipated to have increased to +0.8% mom from +0.6%.

With regards to the energy market, we get the EIA (Energy Information Administration) weekly report on crude inventories for the week ended on May 17th. The forecast is for a 0.60mn barrels decrease, after a 5.43 increase the week before. That said, overnight, the API report revealed a 2.40mn barrels jump and thus, we see the risks surrounding the EIA forecast as tilted to the upside.

As for the speakers, we have four on today’s agenda: ECB President Mario Draghi, ECB Chief Economist Peter Praet, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

70% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure .

Copyright 2019 JFD Group Ltd.

Originally published at https://www.jfdbank.com on May 22, 2019.