Weekly Outlook: Mar 23 — Mar 27: PMIs to Show Economic Damage from the Coronavirus

For another week, investors are likely to keep their gaze locked on headlines surrounding the fast spreading of the coronavirus. Most of this week’s data may attract less attention than usual, but we will look into the preliminary PMIs for March as they could reveal how severe the damages in global economic activity have been. We also have a BoE gathering, but following the Bank’s decision to cut rates twice this month, we don’t expect them to reduce rates further, at least now.

Monday appears to be a very light day in terms of economic indicators and scheduled events, as there are no top tier releases on the economic agenda.

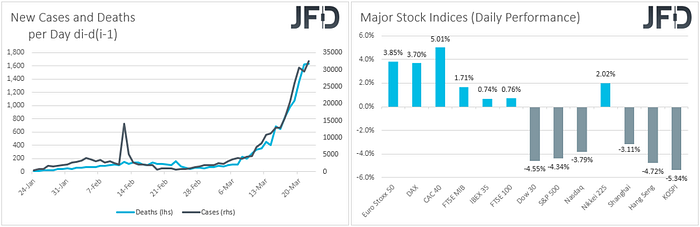

However, investors are likely to stay on the edge of their seats as the theme that’s been driving markets recently has not been data, but headlines surrounding the spreading of the coronavirus. With both new infected cases and new deaths hitting record highs every day, and more nations entering lockdown mode, we stick to our guns that the worst is not behind us yet. Therefore, despite the equity rebound we saw on Thursday and during the Asian and European sessions Friday, investors may be more than willing to abandon again risk assets and seek shelter in safe havens, and especially the greenback. Indeed, US markets closed in the red on Friday, with the negative sentiment rolling into the Asian session today.

As for why we expect the US dollar to continue outperforming even the traditional safe-havens JPY and CHF, it’s because it appears to be the refuge in extremely turbulent market conditions. With the CBOE volatility index (the VIX, or “fear index”) hovering slightly below the 2008 crisis peak, no one can doubt that the phase we are going through is a turbulent one. In a leveraged world, market participants may continue liquidating positions everywhere, even in safe havens like gold, in order to cover losses and margin calls resulting in from holding riskier assets, like equities and risk-linked currencies. In order to change our view, we would like to see headlines that a vaccine is ready for distribution to the whole world.

Tuesday is a PMI day. During the European morning, we get the preliminary manufacturing and services prints from several Eurozone nations and the bloc as a whole. The Euro-area manufacturing index is forecast to have fallen to 39.0 from 49.2, while the services one is anticipated to have slumped to 38.4 from 52.6. This will drive the composite index to 37.8 from 51.6.

We get preliminary PMIs for March from the UK as well, but no forecasts are currently available. The nation’s CBI industrial trend orders for the month are also coming out and the forecast points to a decline further into the negative territory. Specifically, this index is expected to have slid to -30 from -18 in February.

Later in the day, we get the US preliminary PMIs for March. The manufacturing index is expected to have declined to 43.0 from 50.7, while the services one is anticipated to have slid to 42.0 from 49.4. New home sales for February are also due to be released and the forecasts point to a 2.3% mom decline after a 7.9% increase in January.

The fact that all the PMIs are forecast to have tumbled well into the contractionary territory is not a surprise and such slumps may not prove major market movers this time around. With the virus spreading extremely fast outside China during the month of March, investors are already prepared for economic consequences during the first quarter of the year. The big question is whether the wounds would get deeper during the second quarter. As we have been repeatedly noting, we do expect the damages to drag into Q2. With no vaccine ready to be distributed yet, nations are likely to maintain, and even tighten, their restrictive measures, something that inevitably may continue hurting economic activity.

On Wednesday, during the Asian morning, an RBNZ monetary policy meeting was scheduled. However, given that the Bank decided to act outside a scheduled gathering, slashing its benchmark interest rate by 75bps last Monday, the gathering has been canceled. We do get though the nation’s trade balance for February, but no forecast is currently available.

During the European morning, we get the German Ifo survey for March. Both the current assessment and expectations indices are expected to have declined to 93.6 and 81.8 from 99.0 and 93.2 respectively, something that would drive the business climate index down to 87.5 from 96.0. With both the ZEW current conditions and economic sentiment indices for the month tumbling by more than expected last week, we wouldn’t be surprised if the Ifo prints miss their estimates as well.

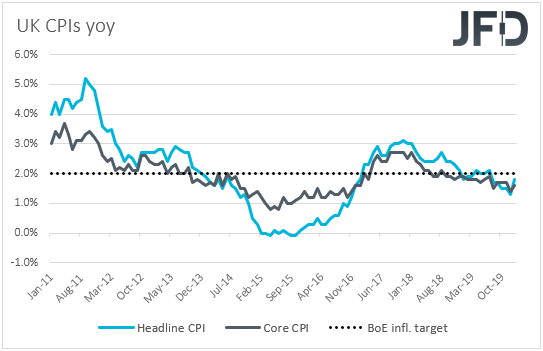

From the UK we get inflation data for February. Both the headline and core CPI rates are forecast to have declined to +1.6% yoy and +1.5% yoy from +1.8% and +1.6% respectively. In a coordinated attempt to prevent a global economic recession, central banks and governments have been ramping up their stimulus efforts. Specifically, the BoE cut rates on March 11 thby 50bps, to 0.25%, and reduced them even further last Thursday, from 0.25% to 0.1%, also reinitiating QE purchases. Thus, it would be interesting to see whether slowing inflation will be the icing on the cake for the Bank to cut rates to zero the following day, although our own view is for no further cuts at this meeting.

In the US, durable goods orders for February are due to be released. Both the headline and core rates are expected to have slid to -0.8% mom and -0.3% mom respectively, from -0.2% and +0.8%. The case for lower durable goods rates is supported by the New Orders sub-index of the ISM manufacturing PMI for the month, which slid to 49.8 from 52.0.

On Thursday, the main event may be the BoE monetary policy decision. As we already noted, it would be interesting to see whether the Bank will decide to cut rates to zero. However, with the Bank already cutting rates twice this month, and also signaling a restart of QE purchases, we don’t expect officials to push the cut button. We believe that they will stand ready to do so if needed, but with little ammunition left, they may be careful with regards to the timing of further easing. Another reason why we expect policymakers to wait for a while before, and if, they decide to act again is the Chancellor’s announcement over a large fiscal spending package.

Apart from the BoE meeting, we also have the UK retail sales for February. Headline sales are anticipated to have slowed to +0.2% mom from +0.9%, while core sales are forecast to have declined 0.1% mom after rising 1.6% in January. Such prints will leave the headline yoy rate unchanged at +0.8%, while they will push the core one just a tick down, to +1.1% yoy from +1.2%. That said, bearing in mind that the yoy rate of the BRC retail sales monitor slid to -0.4% from 0.0%, we would consider the risks of the official retail sales forecasts as tilted to the downside.

From the US, we get the final GDP for Q4, which is expected to confirm its second estimate, namely that the US economy grew 2.1% qoq SAAR during the last three months of 2019. In any case, barring any major deviations from the forecast, we expect this release to pass unnoticed. After all, we have models pointing to how the economy has been performing during the first quarter of this year, during which the outbreak of the coronavirus happened and thus, investors may be more interested on data concerning that period. Surprisingly, the Atlanta Fed GDPNow model points to a 3.1% qoq SAAR growth rate, but the New York Nowcast suggests a slowdown to 1.4% qoq SAAR. Having in mind how turbulent this quarter has been, we lean towards the New York model, but in any case, we will have to wait for the actual data to confirm whether and how much was the economy hurt.

Finally, on Friday, during the Asian morning, Japan releases the Tokyo CPIs for March. No forecast is currently available for the headline rate, but the core one is anticipated to have ticked down to +0.4% yoy from +0.5%.

Later in the day, from the US, we get personal income and spending data for February, alongside the core PCE yoy rate for the month. Personal income is forecast to have slowed to +0.4% mom from +0.6%, something supported by the slide of the average hourly earnings mom rate for the month, while personal spending is anticipated to have grown +0.2% mom, the same pace as in January. That said, bearing in mind that retail sales for the month slid 0.5% mom, we see the risks surrounding the spending forecast as tilted to the downside. With regards to the core PCE yoy rate, which is the Fed’s favorite inflation metric, it is expected to have ticked up to +1.7% yoy from +1.6%.

Having said all that though, we don’t expect these data sets to alter expectations around monetary policy. The Fed and other major central banks have been in a coordinated rescue mission, easing massively their respective policies in order to prevent the global economy from falling into recession, or at least recover as quickly as possible in case it does. Thus, economic data may have been put aside for now, with investors not paying the attention they would have under normal circumstances.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Originally published at https://www.jfdbank.com on March 23, 2020.