Weekly Outlook: May 2 — May 6: FOMC, BoE and RBA Decisions; US and Canada Jobs Data

The economic agenda becomes a bit heavier this week, as there are three major central banks scheduled to announce their monetary policy decisions: the Fed, the BoE and the RBA. All of them are expected to lift rates, and thus, the attention is likely to fall on their hints and signals with regards to their future course of action. On the data front, the most important releases are the New Zealand, US, and Canadian employment reports.

On Monday, the Chinese and UK markets stayed closed in celebration of the Labor Day holiday, with China expected to stay closed until Wednesday.

In terms of economic data, Monday’s agenda appears relatively light. We get the final manufacturing PMIs for April from the Eurozone and the US, and as it is always the case, they are expected to confirm their preliminary estimates. The only release that could attract some attention is the ISM manufacturing index for the month, which is expected to have inched up to 57.6 from 57.1, confirming that the US economy is in a much better shape than its major counterparts, and adding credence to expectations over aggressive tightening by the Fed.

On Tuesday, during the Asian session, the RBA meets to decide on its own monetary policy. The consensus is for a rate hike to 0.25% from 0.10%, something also confirmed by the ASX 30-day interbank cash rate futures yield curve. Thus, with that in mind, a rate hike by itself is unlikely to prove very supportive for the Aussie. If officials indeed push the liftoff button, attention is likely to quickly turn the accompanying statement for clues and hints over the Bank’s future course of action.

According to the aforementioned yield curve, market participants expect interest rates to hit 2.5% by the end of the year, but up until now the RBA itself has not confirmed such aggressive expectations. Thus, putting such a pricing at rest could result in a slide in the Australian currency. For the Aussie to gain in the aftermath of the decision, the Bank’s language may have to support the aforementioned market pricing, something we see as unlikely. One of the reasons we say that is because Australia is an export-oriented nation, and it may not want risking hurting its exports by fueling a strong near-term uptrend in the Aussie.

Apart from Chinese markets, Japan will also stay closed on Tuesday, due to the Constitution Day.

As for the rest of the day, the only data worth mentioning are the German unemployment rate for April, the UK’s final manufacturing PMI for the same month, and the US’s JOLTs job openings for March.

On Wednesday, Chinese and Japanese markets will stay closed, but the Asian calendar is not empty. We do have New Zealand’s employment report for Q1 and Australia’s retail sales for March. In New Zealand, the unemployment rate is expected to have stayed unchanged at 3.2%, and the net employment change to show that the economy has continued to add jobs at the same slow pace as in Q4 last year. The Labor Cost Index though is expected to have risen further, to 3.1% yoy from 2.8%, which could add to speculation of further acceleration in inflation, and thereby revive some speculation over more rate hikes by the RBNZ. Remember that at its latest gathering, the RBNZ lifted rates by 50bps, but hinted that it hiked more now so it can slow down later. As for Australia’s retail sales, the forecast points to a slowdown to +0.5% mom from +1.8%.

Later in the day, the spotlight is likely to fall to the FOMC interest rate decision. The financial community is widely anticipating a 50bps rate hike, and thus, if this is the case, the attention is likely to quickly turn to the accompanying statement and the press conference by Fed Chair Powell for new information about the future rate path.

Hawkish remarks by several Fed officials, including Fed Chair Powell, have prompted investors to fully price in a double hike for this meeting, as well as a triple one in June. They even anticipate another 50bps to be added in July, with a 15% chance of a back-to-back triple hike. That’s overly hawkish and thus, the meeting statement and the press conference have to match that for the US dollar to spike higher. Anything suggesting that the financial community is too aggressive may result a decent setback. Having said all that though, even if this is the case, as long as the Fed is expected to continue tightening at a faster pace than other major central banks, the US dollar is very likely to rebound again and continue its prevailing uptrend.

As for the rest of Wednesday’s events, from the Eurozone, we get the final services and composite PMIs for April, as well as the retail sales for March. From the US, we have the ADP employment report for April, the services and composite Markit PMIs, as well as the ISM non-manufacturing index for April.

On Thursday, Japanese market will stay closed due to the Children’s Day, with the first release during the European morning being Switzerland CPI for April. The yoy rate is forecast to rise somewhat, to +2.6% from +2.4%, but it is unlikely to tempt SNB policymakers to change their mind with regards to monetary policy.

The main event of the day though is likely to be the BoE decision. This will be a Super Thursday for the UK in terms of monetary policy, as besides the decision, the statement and the meeting minutes, we also get the quarterly inflation report and a press conference by Governor Andrew Bailey.

At its latest meeting, this Bank decided to lift rates by another 25bps, as it was widely expected. However, what came as a surprise was the 7–1 voting, with the dissenter calling for no increase at all. Remember that at the February gathering, officials lifted rates by 25 bps as well, but the vote was 5–4, with the dissenters calling for a 50bps increase. Compared to that, March’s decision suggests a more cautious approach.

The consensus for this gathering is for another 25bps liftoff, but this time, market participants see the case for two officials dissenting and favoring standing pat. If this is the case, the market reaction is likely to come from the statement, the minutes, and especially the inflation report. Updated inflation and growth forecasts, as well as rate-path projections, could well signal whether investors’ expectations are reasonable or not. According to the forward curve of the OIS (Overnight Index Swaps), investors see interest rates climbing to near 2.25% by year end. So, anything more hawkish, or just confirming that could support the pound, while the opposite may be true in case the Bank’s projections are more cautious. Bearing in mind the relatively cautious stance the Bank adopted last time, and also the expectations around two dissenters, we see the latter case as more likely.

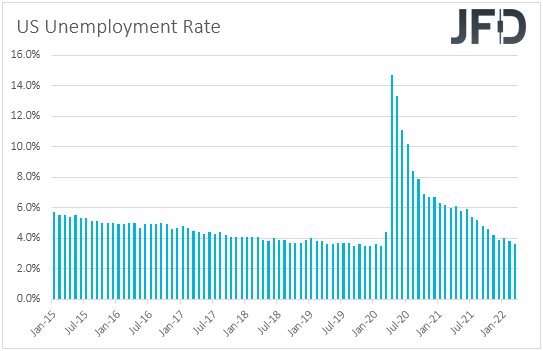

Finally, on Friday, investors are likely to turn their gaze to the employment reports for April from the US and Canada. Getting the ball rolling with the US, nonfarm payrolls are expected to have slowed somewhat, to 380k from 431k, but the unemployment rate is expected to have ticked down to 3.5% from 3.6%. Average hourly earnings are forecast to have increased at the same monthly pace as in March, but this will result in a downtick to +5.5% from +5.6% in the yoy rate.

Conditional upon the Fed hiking by 50bps on Wednesday and staying in course for more sizable increments, we do see the case of such numbers adding more credence to that view, despite a small slowdown in payrolls and wages. In other words, conditional upon the US dollar maintaining its uptrend on Wednesday, we expect it to stay in that course after the employment report as well.

Now, flying to Canada, the unemployment rate is forecast to slide to 5.2% form 5.3% and the net change in employment to slow somewhat, to 57.5k from 72.5k. At its latest gathering, the BoC decided to hike rates by 50bps as was expected, noting that interest rates will need to rise further. Governor Macklem specifically said, “We need higher rates, and the economy can handle them”, adding that they are prepared to move as forcefully as needed to get inflation on target.

With that in mind, and also taking into account that inflation accelerated by much more than expected in March, we believe that a decent employment report could add more support to the Canadian dollar, especially against currencies the central banks of which are expected to stay dovish or proceed in a much more cautious manner than the BoC in normalizing their policy. Nonetheless, due to the aggressive expectations surrounding the Fed, we don’t expect the Loonie to outperform the US dollar as well. We believe that there is still some more upside for USD/CAD.

As for the rest of Friday’s events, during the Asian session, we get the Tokyo CPIs for April, while during the European trading, the UK construction PMI for April is due to be released.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.82% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2022 JFD Group Ltd.

Originally published at https://www.jfdbrokers.com.