Weekly Outlook: Oct 19 — Oct 23: UK, Canada and NZ CPIs; Preliminary PMIs in Focus

The main items on this week’s agenda are the UK, the Canadian and New Zealand’s inflation numbers, which will provide a guidance as to how the respective central banks may plan to move forward at their upcoming gatherings. We also get the preliminary PMIs for October from several nations around the world, which will be a first sign on how the global economy has performed with covid cases hitting new daily record highs.

On Monday, during the Asian session, we already got China’s GDP for Q3, as well as the nation’s industrial production, fixed asset investment and retail sales, all for September. GDP slowed to +2.7% qoq from +11.5%, missing estimates of +3.2%, but this took the yoy rate higher, to +4.9% from +3.2%. Industrial production and retail sales accelerated to +6.9% yoy and +3.3% yoy from +5.6% and +0.5%, while fixed asset investment rebounded 0.8% yoy after sliding 0.3% in August.

Later in the day, we have the BoC business outlook survey.

On Tuesday, US building permits and housing starts, both for September, are due to be released. Both are expected to have increased somewhat.

On Wednesday, during the early European morning, we get the UK CPIs for September. Both the headline and core rates are expected to have increased to +0.6% yoy and +1.3% yoy from +0.2% and +0.9% respectively.

At their latest meeting, BoE policymakers noted that they are exploring how a negative bank rate could be implemented effectively, something that increased speculation over the adoption of sub-zero rates at one of the Bank’s upcoming gatherings. That said, combined with Deputy Governor Dave Ramsden’s recent remarks that he and his colleagues are not about to use negative interest rates immediately, accelerating inflation may allow BoE officials to stay sidelined at their next gathering.

The pound could gain somewhat on accelerating consumer prices, but as we noted several times in the past, most of the currency’s faith will stay depended on developments surrounding the Brexit landscape. Last week, the EU and the UK failed to make any significant progress in trade talks, with UK PM Johnson saying that the UK should get ready for a no-deal exit. That said, he stopped short of announcing that his nation will walk away from trade talks, keeping on the table hopes that a deal could still be reached before December 31 st, when the transition period ends. Thus, anything suggesting that the two sides are willing to resolve their differences may support the pound, while the opposite may be true if headlines point to no narrowing of the differences-gap.

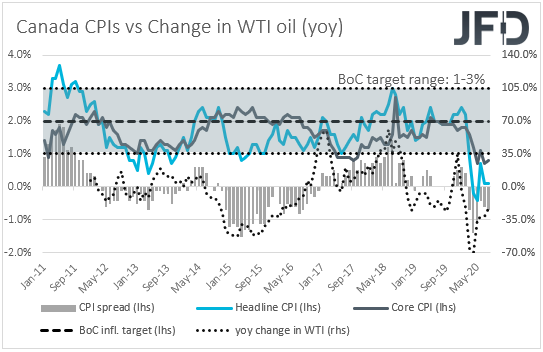

Later in the day, we get inflation data for September from Canada as well. The headline CPI rate is expected to have risen to +0.4% yoy from +0.1%, but no forecast is available for the core one, which stood at +0.8% yoy in August.

At its prior gathering, the BoC kept interest rates unchanged at +0.25%, repeating that they will stay there until the 2% inflation target is sustainably achieved. They also reiterated the view that they will continue with their QE program until the economic recovery is well underway, and that they stand ready to adjust their programs if market conditions change. They said that both the global and Canadian economies are evolving broadly in line with the scenario outlined in July, but added that the bounce-back in activity in the third quarter looks to be faster than anticipated in July. With all that in mind, and also taking into account that the employment report for September beat estimates, accelerating CPIs may allow BoC policymakers to continue sitting comfortably on the sidelines for a while more.

In the US, the Senate is due to vote on a USD 300bn Republican coronavirus relief bill, an amount significantly smaller than the USD 2trl demanded by Democrats. Thus, the chances for the bill to pass are very slim, something that could increase the probability for no accord before the November 3 rdelection, even as the number of coronavirus infections keeps rising at a fast pace and job growth is stalling. With the election day drawing closer, another failure to reach consensus could weigh on riskier assets, with investors seeking shelter in safe havens.

Thursday is a relatively light day with the only release worth mentioning being the US existing home sales for September. The forecast points to an acceleration to +3.3% mom from +2.4% in August.

Finally, on Friday, during the Asian morning, we have New Zealand’s CPI for Q3, but no forecast is available for neither the qoq rate nor the yoy one. At its last meeting, the RBNZ kept its Official Cash Rate (OCR) and its Large-Scale Asset Purchase (LSAP) unchanged, repeating that further monetary stimulus may be needed in the foreseeable future, including a Funding for Lending Program, a negative OCR, and purchases of foreign assets.

That said, recently, RBNZ Assistant Governor Christian Hawkesby said that some economic data have surprised to the upside, reducing the chances for the adoption of negative interest rates by this Bank. However, he added that the discussion of negative rates is “not a game of bluff”, keeping the prospect well on the table. With that in mind, a better-than-expected CPI may reduce the chances of policymakers acting at the next gathering, scheduled for November 11th, and thereby support the Kiwi, while a disappointment may revive some speculation for an imminent cut, which could result in a slide in the local currency.

We get CPI data from Japan as well, but for the month of September. No forecast is available for the headline rate, while the core one is anticipated to have remained unchanged at -0.4% yoy. The headline Tokyo rate slid to +0.2% yoy from +0.3%, but the core one ticked up to -0.2% yoy from -0.3%. This suggests that the National rates may move in a similar fashion as well.

Later in the day, we get the preliminary manufacturing, services and composite PMIs for October from several Eurozone nations and the bloc as a whole, the UK and the US. These data sets will give us a first taste on how the global economy has performed during the month of October, with the coronavirus keep spreading fast and hitting new record highs in daily infections. Both the Eurozone manufacturing and services PMIs are expected to have declined to 53.1 and 47.0, from 53.7 and 48.0 respectively, something that will drive the composite PMI below the boom-or-bust zone of 50. Specifically, the composite index is forecast to have slid to 49.5 from 50.4. This is likely to prove negative for the euro, as it will reveal that the second wave of coronavirus infections is leaving more marks on the Euro-area economy.

In the UK, the manufacturing index is expected to have increased to 54.3 from 54.1, while the services one is anticipated to have declined to 55.0 from 56.1. This will result in a downtick in the composite PMI, to 55.6 from 55.7. With regards to the US data, the manufacturing PMI is forecast to have inched up to 53.4 from 53.2, while the services one is expected to have ticked down to 54.5 from 54.6. The UK retail sales for September are also coming out, with the headline rate expected to have slid to +0.5% mom from +0.8%, and the core one to have ticked down to +0.5% mom from +0.6%.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. The Group of Companies of JFD, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.25% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2020 JFD Group Ltd.

Originally published at https://www.jfdbank.com on October 19, 2020.